Builders Risk Insurance in Colorado

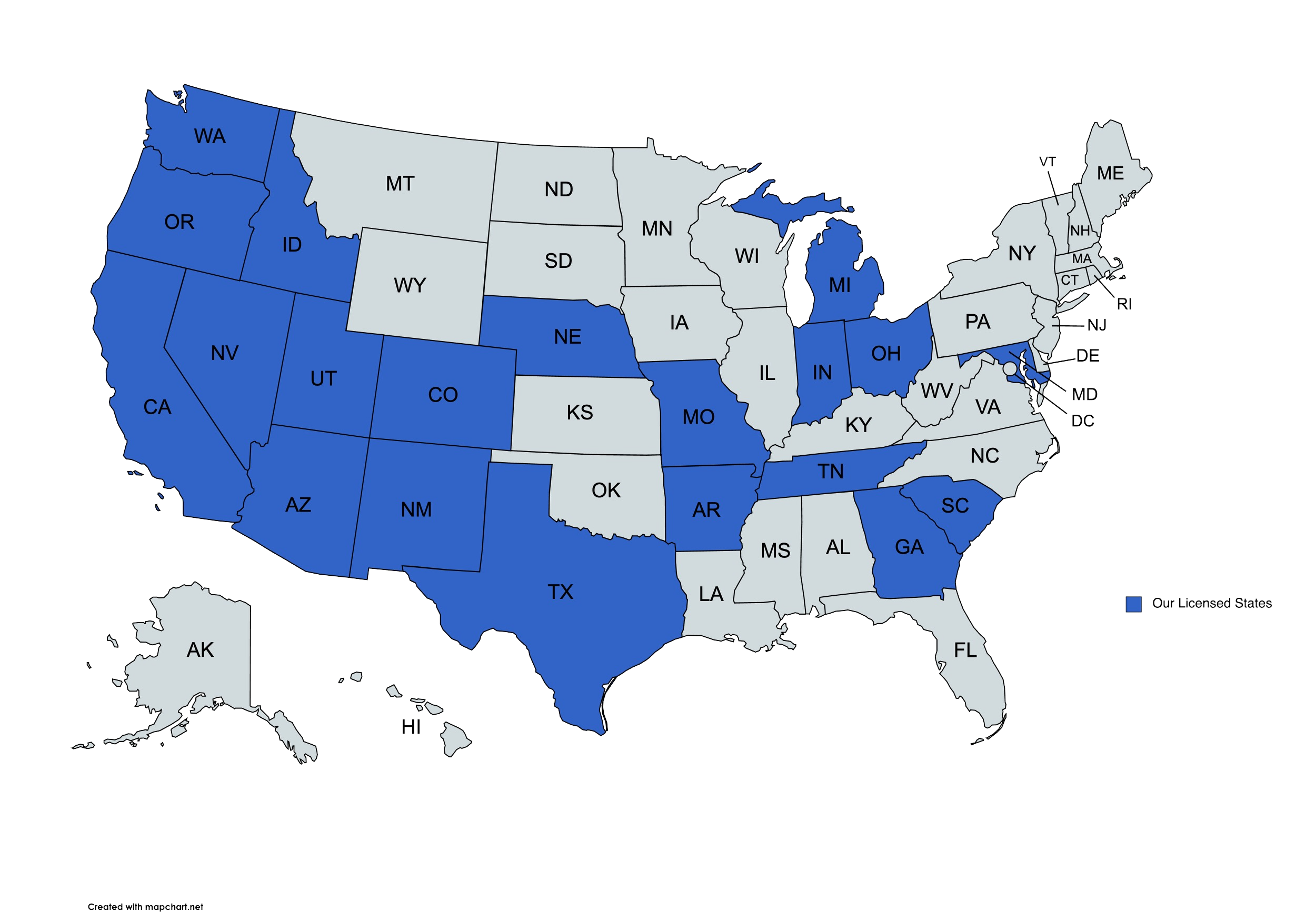

We provide builder’s risk insurance solutions to businesses in Colorado and beyond.

Builders Risk Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is builders risk insurance?

Delays are commonplace in construction, especially when working on large commercial projects. Sometimes the costs associated with delays can be passed onto contractors. To help protect against this potential risk, contractors in Colorado may want builders risk insurance.

Builders risk insurance offers specialized coverage for construction projects that could be delayed. Coverage may provide protection if there’s a delay, or the project is never finished.

When do construction companies in Colorado need builders risk coverage?

Colorado construction companies may need builders risk coverage when undertaking a major construction project. Many commercial projects require that the contractor purchase this coverage. Without coverage, such jobs may be unavailable to a construction company.

When coverage is required, it may be a stipulation coming from the customer or the lender. Such requirements are intended to safeguard the customer or lender from financial costs if the work isn’t done on time.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

What assets can builders risk coverage insure?

Builders risk coverage might also protect a construction company’s stuff at a job site. Any protection is typically is normally restricted to the job site, but most items at the site can be protected. For instance, a policy might extend coverage to:

- Structures in progress

- Structures once completed

- Large machinery and equipment

- Smaller equipment

- Specialized and common tools

- Building materials and supplies

While all coverages can vary from one policy to the next, coverage for structures is particularly policy-specific. An insurance agent specializing in builders risk can help construction companies make sure they find a policy with protection for in-progress and completed structures, or whatever structures they need protected.

What types of construction projects can be insured with builders risk coverage?

Builders risk policies are primarily used for larger construction projects, particularly commercial ones. Some examples of projects that coverage might be procured for include:

- Apartment complexes

- Housing developments

- Retail centers

- Office buildings

- Industrial facilities

- Warehouses

- Public infrastructure projects

In some cases, coverage will be used for major renovations of larger buildings. Major landscaping and hardscaping work is covered less often, but policies might still be available to large-scale landscapers.

Can builders risk policies be purchased for single-family home construction?

Builders risk policies normally aren’t purchased for the construction of one house. These policies are primarily used for larger projects, when the potential cost of delay easily justifies paying premiums.

In the uncommon scenario where a homeowner insists on builders risk coverage for their new home build, an insurance agent who understands builders risk policies well may be able to find a suitable one.

Which perils are covered by builders risk policies?

Builders risk policies might protect against a variety of risks. These can include:

- Severe weather

- Fire and smoke

- Theft and vandalism

- Certain water damage

- Other perils as detailed

Can builders risk policies be extended if there’s a delay in construction?

Many builders risk policies allow construction companies to extend the policy if work isn’t completed by the expected deadline. Policies frequently have a limit of one extension, and often require a new policy beyond a single extension. Some policies may have different terms, though, either offering no or multiple extensions.

If a policy needs to be extended, or if another policy is needed, this is something that an experienced insurance agent can help with.

How much does it cost to get builders risk coverage?

The cost of builders risk coverage varies, depending on factors like the following:

- Project type, size and location

- Equipment and tools used

- Expected timeline

- Company history

- Claims history

Construction companies can get precise quotes for their projects by consulting with an independent insurance agent, who’ll be able to check quotes from several insurance companies.

Where can Colorado construction companies get builders risk insurance?

If you run a construction company in Colorado that needs builders risk insurance for a larger project, contact the independent insurance agents at The DeLuca Agency. Our agents will work closely with you to determine what a policy should cover, and then help you find a policy that’ll meet your company’s coverage needs well.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com