Amazon Truck Insurance in Colorado

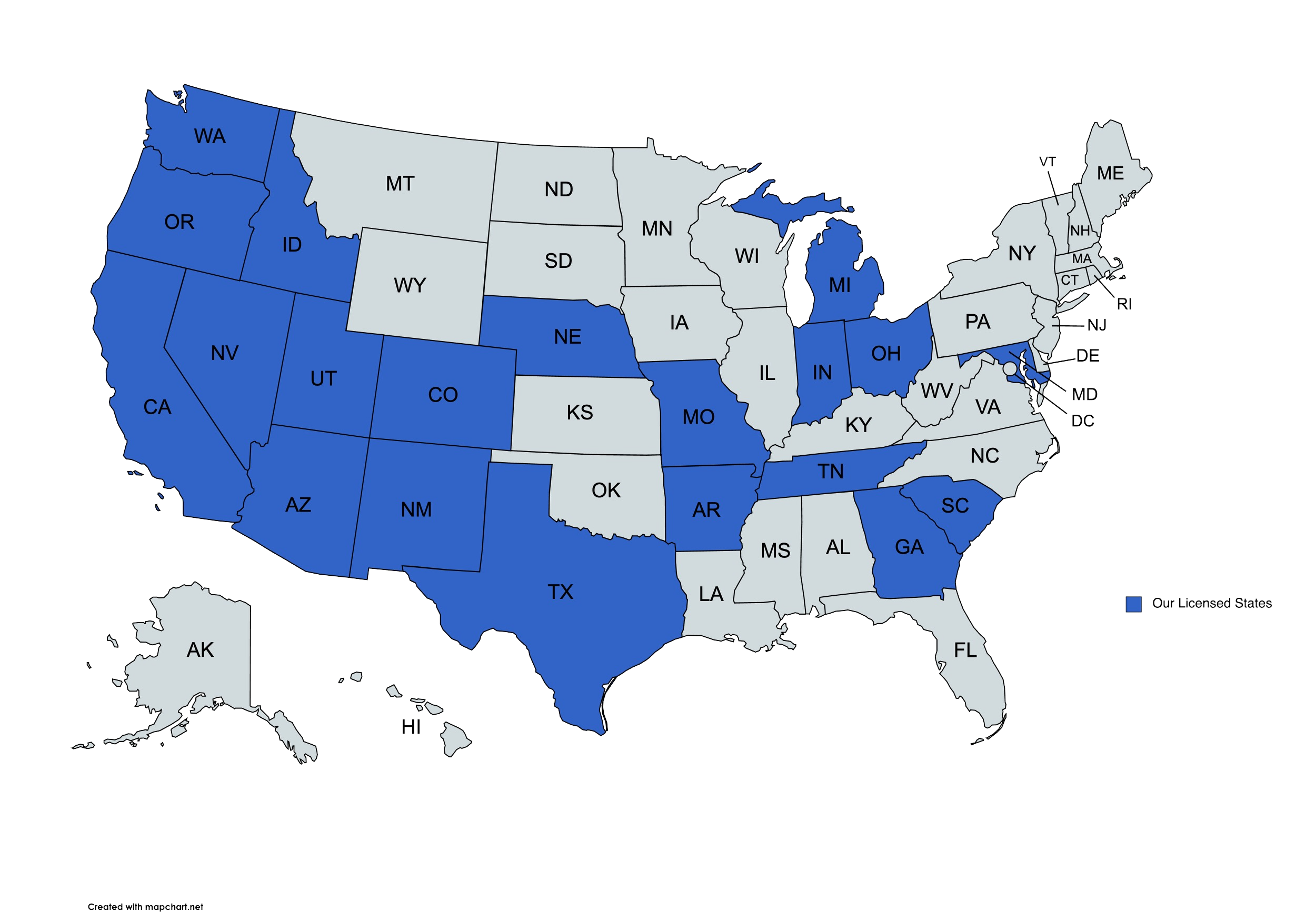

We provide Amazon truck insurance solutions to businesses in Colorado and beyond.

Amazon Truck Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is Amazon truck insurance?

Amazon truck insurance is a specialized insurance policy designed for those involved in Amazon’s delivery program, including independent contractors and fleet owners. Whether you are delivering packages for Amazon Flex or as part of the Amazon Delivery Service Partner (DSP) program, having the right insurance is critical for operating safely and in compliance with Amazon’s requirements.

What’s the difference between Amazon truck insurance and regular commercial auto insurance?

The main difference between Amazon truck insurance and regular commercial auto insurance lies in the specific coverage tailored to the risks associated with Amazon deliveries. Amazon truck insurance is designed to meet the requirements set by Amazon, including coverage for cargo (the packages you’re delivering), as well as specific liability coverage that addresses the unique risks associated with Amazon’s delivery operations. Regular commercial auto insurance, on the other hand, is more general and may not include the specific protections that Amazon drivers need. Regular commercial auto insurance is typically used for a wider range of vehicles and business operations, whereas Amazon truck insurance is tailored to meet the needs of those delivering packages within Amazon’s network. If you operate under Amazon’s delivery program, it’s essential to have the right Amazon truck insurance policy that aligns with Amazon’s standards and requirements.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

What types of coverage are included in Amazon truck insurance?

Amazon truck insurance offers several types of coverage to protect you and your vehicle in various situations. Here are the common options:

- Collision Coverage: Covers damage to your truck from a collision, regardless of fault, whether with another vehicle or an object like a guardrail.

- Comprehensive Coverage: Protects against non-collision events such as weather damage (hail, wind), theft, vandalism, or animal collisions. Especially important in places like Colorado with severe weather.

- Cargo Insurance: Essential for Amazon drivers, this coverage protects the packages you’re delivering in case they are damaged or stolen while in your care.

- Uninsured/Underinsured Motorist Coverage: Covers costs if you’re involved in an accident with a driver who doesn’t have sufficient insurance.

- Medical Payments Coverage: Helps pay for medical expenses resulting from an accident, regardless of fault, covering you or your passengers.

- Workers’ Compensation: Required if you employ others, it covers medical care and lost wages if an employee is injured while working.

- Loss of Income Insurance: Provides financial support if your truck is out of commission after an accident, helping to offset lost income during downtime.

Does the insurance cover damage to trucks while parked or stored?

Yes, Amazon truck insurance typically includes comprehensive coverage, which protects your truck from damage while it is parked or stored. Comprehensive coverage covers non-collision incidents, such as vandalism, theft, weather-related damage, or damage caused by falling objects when the truck is not in use. However, it’s essential to verify the details of your specific policy, as some policies may have exclusions or conditions regarding parked vehicles. Be sure to review your insurance contract or speak with your agent to ensure that your truck is covered while parked or in storage, especially during off-seasons or when not actively making deliveries.

Does the insurance cover both full-time and seasonal drivers?

Yes, Amazon truck insurance can cover both full-time and seasonal drivers, but it depends on the specifics of your policy. If you operate a fleet or have additional drivers, you can include both full-time employees and seasonal drivers under your insurance policy. Some policies may offer flexible terms that allow for adjustments in coverage depending on the number of drivers or the time of year. If you have seasonal drivers working during peak delivery periods, be sure to inform your insurer so that they can adjust the coverage as necessary to reflect the changes in your operation.

Can I adjust coverage levels based on delivery volume or seasonal needs?

Yes, many Amazon truck insurance policies offer flexibility to adjust coverage levels based on delivery volume or seasonal needs. For example, during peak delivery seasons such as the holidays, you may need to increase your coverage to account for a higher volume of deliveries, more drivers, or increased risks. Conversely, during off-peak times, you may be able to reduce coverage levels to save on premiums. Discussing these adjustments with your insurer can help ensure that you have the appropriate coverage for each season or fluctuation in delivery volume, making your policy more cost-effective while maintaining adequate protection.

What factors affect the cost of Amazon truck insurance in Colorado?

Several factors influence the cost of Amazon truck insurance:

- Truck Type and Value: Larger, newer, or specialized trucks tend to have higher premiums due to their higher value and repair costs. Trucks with advanced safety features may lower your premiums.

- Driving History and Claims Record: A clean driving record with no accidents or traffic violations may help reduce your premiums. On the other hand, a history of accidents or claims may increase your costs.

- Location: The area where you operate in Colorado matters. Cities with heavy traffic or regions prone to severe weather (like snowstorms or hail) may lead to higher premiums due to increased risks of accidents and property damage.

- Annual Mileage: The more miles you drive, the higher your premium, as more driving increases the risk of accidents. Driving in challenging conditions, such as mountain roads or icy areas, may further raise your insurance costs.

- Deductibles: A higher deductible typically lowers your premium, while a lower deductible increases it. Choose a deductible you may comfortably pay if you need to file a claim.

- Insurance Provider: Different insurers offer varying rates and coverage options. It’s wise to compare quotes from multiple providers to find the best rate for the coverage you need.

How can businesses in Colorado obtain Amazon truck insurance?

Reach out to the independent agents at The DeLuca Agency for a fast quote on Amazon truck insurance in Colorado. Our team of experts is dedicated to helping you find the right coverage to protect your business, whether you’re an independent contractor or managing a fleet. We understand the unique risks of Amazon deliveries and can customize a policy that meets your needs while keeping your premiums affordable. Don’t wait until an accident or unexpected event catches you off guard—contact The DeLuca Agency today to secure the protection you need and keep your Amazon trucking operations running smoothly.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com