Cyber Insurance in Colorado

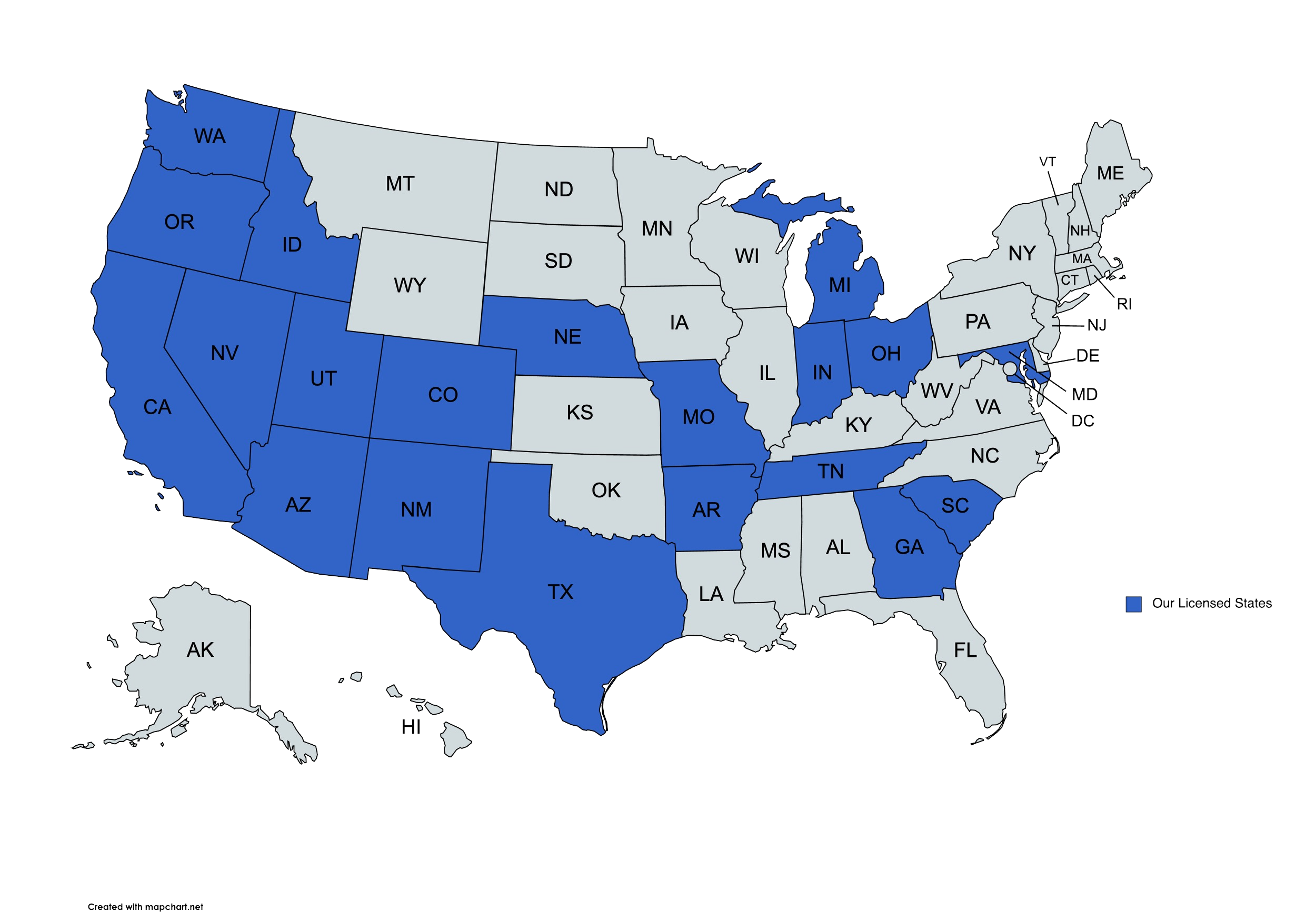

We provide cyber insurance solutions to businesses in Colorado and beyond.

Cyber Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is cyber insurance?

Cyber insurance is a specialized type of coverage designed to protect businesses from the financial fallout of cyberattacks, data breaches, and other digital threats. As businesses in Colorado increasingly rely on digital technologies, the risk of cyber incidents has grown exponentially. Cyber insurance helps mitigate these risks by covering costs related to data recovery, legal fees, notification expenses, and more. For Colorado businesses, where the tech industry and digital commerce are booming, cyber insurance is not just an option—it’s a necessity.

How does cyber insurance work?

Cyber insurance policies typically cover a range of incidents, including data breaches, ransomware attacks, and business interruptions caused by cyber events. When a covered event occurs, the policyholder files a claim with their insurer. The insurance company then investigates the claim and, if approved, covers the costs as outlined in the policy. This may include legal fees, public relations efforts, and the cost of notifying affected customers. In Colorado, where the regulatory environment is increasingly stringent, having cyber insurance ensures that businesses can comply with legal requirements without suffering financial ruin.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

What types of coverage are available under cyber insurance?

Cyber insurance policies offer a variety of coverage options to meet the specific needs of businesses. Common types of coverage include:

- Data Breach Coverage: This covers the costs associated with notifying customers, providing credit monitoring services, and handling public relations efforts.

- Cyber Extortion Coverage: This helps businesses respond to ransomware attacks by covering ransom payments and related expenses.

- Business Interruption Coverage: If a cyber incident disrupts business operations, this coverage helps offset lost income.

- Network Security Liability: This covers legal fees and settlements if your business is sued for failing to prevent a cyberattack.

For Colorado businesses, it’s crucial to tailor cyber insurance coverage to address the unique risks they face, whether from local regulations or industry-specific vulnerabilities.

How much does cyber insurance cost for Colorado businesses?

The cost of cyber insurance varies depending on several factors, including the size of the business, the industry, and the level of coverage required. In Colorado, where businesses range from small startups to large enterprises, premiums can vary widely. On average, small to medium-sized businesses can expect to pay between $1,000 and $7,500 annually for cyber insurance. Factors that influence the cost include:

Business Size: Larger businesses with more employees and data are at greater risk and typically pay higher premiums.

Industry: Industries like healthcare, finance, and retail, which handle sensitive data, are at higher risk and may face higher premiums.

Coverage Limits: The more comprehensive the coverage, the higher the premium. Businesses in Colorado should carefully assess their risks to determine the appropriate level of coverage.

What are the key benefits of cyber insurance for Colorado businesses?

Cyber insurance offers several key benefits, making it an essential investment for Colorado businesses:

Financial Protection: Cyber insurance helps cover the significant costs associated with a cyber incident, from legal fees to data recovery.

Compliance Assistance: With Colorado’s evolving regulatory landscape, cyber insurance can help businesses meet legal obligations, such as customer notification and data protection requirements.

Reputation Management: A cyber incident can severely damage a business’s reputation. Cyber insurance often includes coverage for public relations efforts to help restore trust with customers and stakeholders.

Business Continuity: Cyber insurance provides coverage for business interruptions, helping companies recover more quickly and minimize downtime.

Are Colorado businesses legally required to have cyber insurance?

While there is no federal law mandating cyber insurance, businesses in Colorado are subject to state regulations that require them to protect consumer data. The Colorado Privacy Act (CPA), for instance, mandates strict data protection standards. While the CPA does not explicitly require cyber insurance, having a policy in place can help businesses comply with these regulations and protect themselves from the financial impact of non-compliance. Additionally, certain industries, such as finance and healthcare, may have specific regulatory requirements that make cyber insurance a practical necessity.

How can a Colorado business choose the right cyber insurance policy?

Selecting the right cyber insurance policy involves assessing your business’s unique risks and needs. Here are some steps to consider:

- Assess Your Risks: Identify the types of cyber threats your business is most vulnerable to, whether it’s data breaches, ransomware, or business interruption.

- Determine Coverage Needs: Based on your risk assessment, determine the types and levels of coverage you need. Colorado businesses should consider state-specific risks, such as compliance with local regulations.

- Compare Policies: Not all cyber insurance policies are created equal. Compare policies from different providers to find one that offers the best protection at a reasonable price.

- Work with a Broker: Consider working with an insurance broker who specializes in cyber insurance. They can help you navigate the complexities of coverage options and find a policy that fits your business’s needs.

How can businesses in Colorado get cyber insurance?

For cyber insurance in Colorado, reach out to the independent insurance agents at The DeLuca Agency. We’ll work closely with you to find a cyber insurance solution that’ll provide solid protection for your business.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com