Non-Emergency Medical Transport Insurance Colorado Colorado

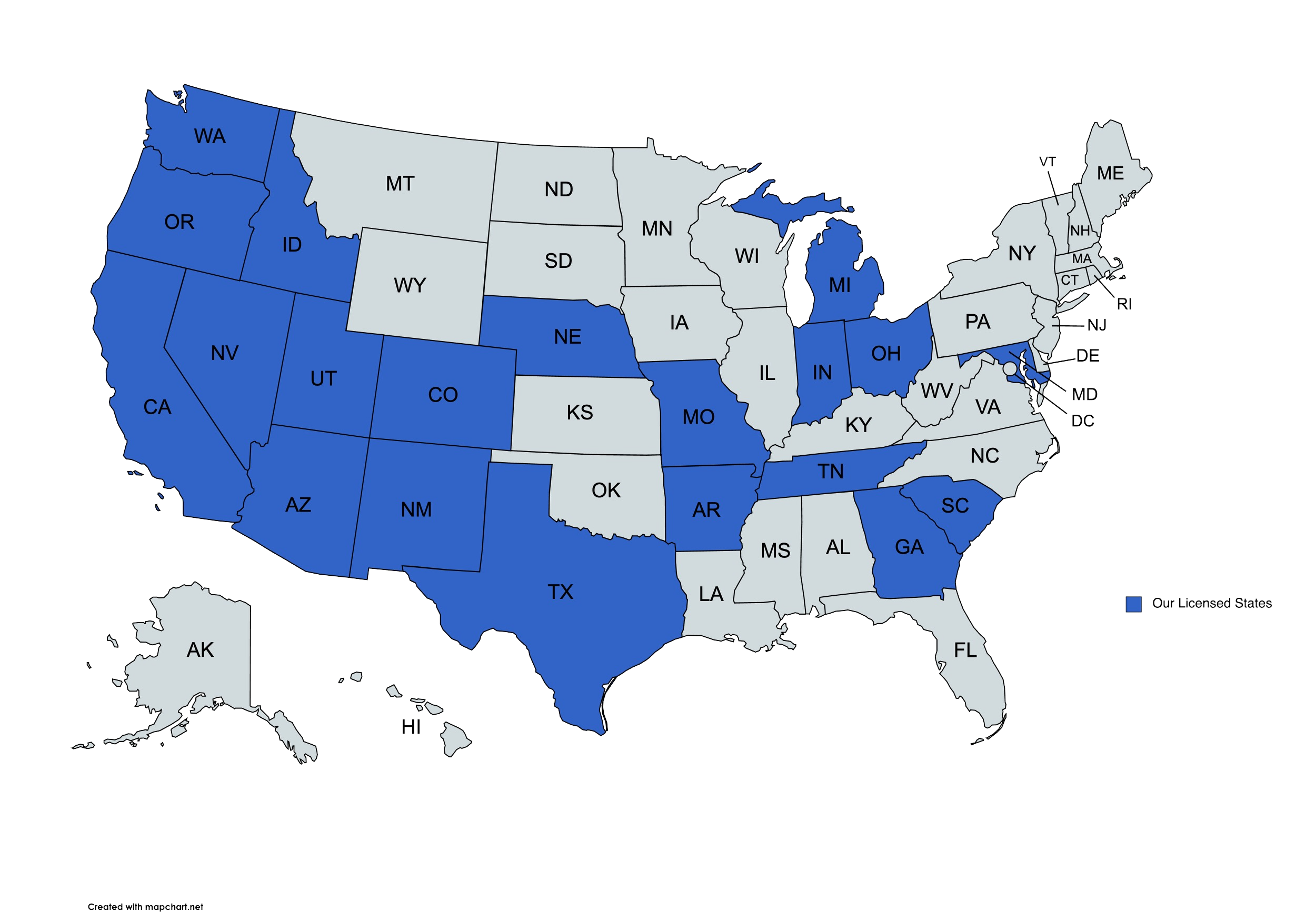

We provide non-emergency medical transport insurance solutions to businesses in Colorado and beyond.

Non-Emergency Medical Transport Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is non-emergency medical transport insurance?

Non-emergency medical transport insurance (NEMT) is specialized coverage designed for businesses that provide transportation services for individuals who require medical care but do not need emergency transportation. This type of insurance is essential for companies that transport patients to and from medical appointments, rehabilitation sessions, dialysis treatments, and other non-emergency medical services. It offers protection against a variety of risks, including vehicle accidents, liability claims, and damage to medical equipment.

Why is non-emergency medical transport insurance important for businesses in Colorado?

Non-emergency medical transport insurance is crucial for businesses in Colorado due to the state’s diverse terrain, varying weather conditions, and increasing demand for medical transportation services. Colorado’s mountainous regions and unpredictable weather may present unique challenges for NEMT providers, making comprehensive insurance coverage essential. Additionally, as the population ages and the need for medical transport services grows, having the right insurance coverage helps businesses manage risks and operate smoothly.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

Who needs non-emergency medical transport insurance?

Non-emergency medical transport insurance is typically needed by several groups in Colorado, including:

- Medical Transportation Providers: Companies or individuals who offer non-emergency medical transportation services, such as transporting patients to and from medical appointments or facilities, need insurance to cover their vehicles and operations.

- Healthcare Facilities: Hospitals, clinics, or nursing homes that arrange non-emergency medical transportation for their patients might need insurance to cover any liability or damages associated with these services.

- Individuals with Special Needs: People who frequently require non-emergency medical transport due to chronic conditions, disabilities, or age-related issues may benefit from having insurance that covers the costs of transportation services.

- Insurance Brokers and Agents: Professionals who arrange or manage non-emergency medical transport insurance policies need to understand and offer appropriate coverage for their clients.

- Caregivers and Personal Assistants: Those who assist individuals with medical transportation needs as part of their caregiving duties may need insurance to protect against any liabilities or damages that might occur during transport.

What does non-emergency medical transport insurance cover?

Non-emergency medical transport insurance offers a range of coverages designed to protect NEMT businesses from various risks associated with their operations. Key coverages typically include:

- Commercial auto liability: This covers bodily injury and property damage that may occur as a result of a vehicle accident involving your NEMT vehicle. It protects your business from claims made by third parties for medical expenses, vehicle repairs, and legal fees.

- Physical damage coverage: This coverage protects your NEMT vehicles from damage caused by collisions, theft, vandalism, or other covered events. It includes collision and comprehensive coverage to ensure that your vehicles are repaired or replaced in the event of an accident or other incident.

- General liability insurance: This coverage protects your business from claims related to bodily injury, property damage, or personal injury that occurs as a result of your business operations. For example, if a patient is injured while getting into or out of your vehicle, general liability insurance would cover the associated medical expenses and legal costs.

- Workers’ compensation insurance: This coverage provides benefits to your employees if they are injured or become ill as a result of their job. It covers medical expenses, lost wages, and rehabilitation costs, helping to protect your business from the financial impact of employee injuries.

- Professional liability insurance: Also known as errors and omissions (E&O) insurance, this coverage protects your business from claims of negligence or failure to provide the expected level of service. It covers legal defense costs and settlements if a client sues your business for errors in service.

- Medical payments coverage: This provides coverage for medical expenses incurred by passengers in your vehicle, regardless of who is at fault for the accident. It ensures that immediate medical care is available for passengers injured during transport.

- Uninsured/underinsured motorist coverage: This coverage protects your business if your NEMT vehicle is involved in an accident with a driver who does not have sufficient insurance to cover the damages. It provides compensation for injuries and property damage caused by uninsured or underinsured drivers.

What are the common claims in non-emergency medical transport insurance?

Common claims in non-emergency medical transport insurance typically include:

- Vehicle Accidents: Collisions or crashes involving the transport vehicle, which may result in damage to the vehicle, injuries to passengers, or damage to other property.

- Passenger Injuries: Injuries sustained by passengers while being transported, which could result from accidents or issues with the vehicle’s safety equipment.

- Vehicle Damage: Claims for damage to the transport vehicle that occurs due to accidents, vandalism, or other incidents.

- Medical Equipment Damage: Damage to or loss of medical equipment carried in the vehicle, such as wheelchairs, stretchers, or other specialized equipment.

- Liability Claims: Legal claims arising from accidents or incidents involving the transport service, including third-party claims for injury or property damage.

- Driver Errors: Claims related to errors or negligence on the part of the driver, such as failing to follow safety protocols or misjudging road conditions.

- Delayed or Missed Appointments: Claims arising from failure to transport patients to their medical appointments on time, potentially leading to additional costs or medical complications.

- Breach of Contract: Claims related to failure to meet contractual obligations regarding the quality or timeliness of the transport service.

- Damage to Property: Claims for damage caused to property during the transport, such as damage to the facilities where the vehicle is parked or to the medical facilities themselves.

What factors affect the cost of non-emergency medical transport insurance in Colorado?

The cost of non-emergency medical transport insurance in Colorado can be influenced by several factors, including:

- Type and Size of the Fleet: The number and type of vehicles (e.g., standard cars, vans, or specialized vehicles) used for transport can impact the insurance cost. Larger fleets or vehicles with more complex equipment might incur higher premiums.

- Vehicle Usage: The frequency and distance of trips, as well as the types of services provided, can affect costs. Higher usage and longer trips typically increase the risk, leading to higher insurance premiums.

- Driver Qualifications and Experience: The experience and qualifications of drivers, including their driving history and any specialized training (e.g., for transporting patients with specific needs), can influence insurance costs. More experienced drivers might help lower premiums.

- Coverage Limits and Deductibles: The level of coverage you choose, including liability limits and deductibles, will impact the cost. Higher coverage limits generally lead to higher premiums, but they offer more protection.

- Claims History: A history of previous claims can increase premiums, as insurers may view the business as higher risk.

- Type of Coverage: The specific types of coverage included, such as liability, vehicle damage, medical payments, and cargo coverage, will affect the overall cost. Comprehensive coverage options usually cost more.

- Location and Risk Factors: The geographic location and specific risks associated with operating in different areas of Colorado can impact the cost. Urban areas with higher traffic and accident rates might see higher premiums compared to rural areas.

- Regulatory Requirements: Compliance with state and local regulations for non-emergency medical transport services can influence insurance costs. Ensuring all regulatory requirements are met can sometimes help in securing more favorable rates.

How can businesses obtain non-emergency medical transport insurance in Colorado?

Reach out to the independent agents at DeLuca Agency for a fast quote on non-emergency medical transport insurance in Colorado and ensure your business has the coverage it needs to operate safely and efficiently. Our knowledgeable team understands the unique risks and requirements of the NEMT industry and is ready to help you find a customized insurance solution that fits your specific needs. With the right coverage in place, you may focus on providing exceptional service to your clients, knowing that your business is protected against unexpected events.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com