VRBO Insurance in Colorado

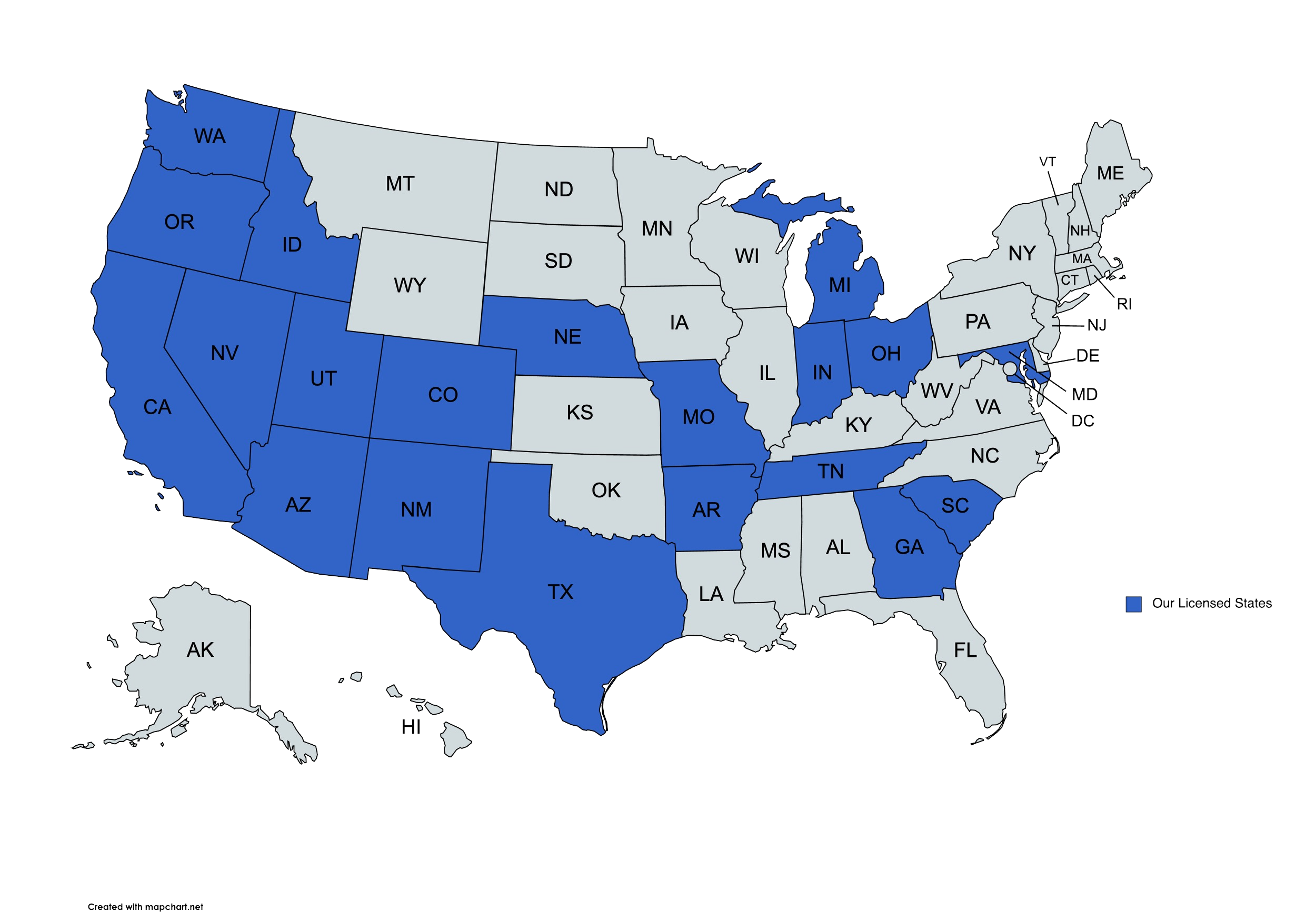

We provide VRBO insurance solutions to businesses in Colorado and beyond.

VRBO Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

What is VRBO insurance?

VRBO insurance is specialized coverage designed to protect property owners who rent out their homes, condos, or vacation properties through VRBO (Vacation Rentals by Owner). This type of insurance is specifically tailored to address the unique risks associated with short-term rentals, including property damage, liability claims, and loss of income. Standard homeowners insurance often does not cover rental activities, making VRBO insurance a crucial component for hosts who want comprehensive protection for their rental properties.

Why is VRBO insurance important for property owners in Colorado?

VRBO insurance is especially important for property owners in Colorado, where the short-term rental market is thriving due to the state’s popularity as a travel destination. Colorado’s stunning landscapes, ski resorts, and outdoor activities attract tourists year-round, increasing the demand for short-term rentals. However, this also heightens the risks associated with renting out properties to a diverse range of guests, from families on vacation to large groups of skiers or hikers.

In Colorado, property owners face unique challenges such as harsh weather conditions, high guest turnover, and the potential for property damage or liability claims. VRBO insurance provides essential protection against these risks, offering peace of mind to hosts by covering damages, liability issues, and potential income losses. Additionally, Colorado’s local regulations and HOA requirements often mandate specific insurance coverage for short-term rentals, making it critical for property owners to secure appropriate VRBO insurance.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

What does VRBO insurance cover?

VRBO insurance covers a wide range of risks associated with short-term rentals. The specific coverage may vary based on the insurance provider and policy chosen, but typically includes the following:

- Property damage protection: This covers damage to the property caused by guests, including structural damage, broken appliances, or damage to furniture and other personal belongings. It also includes coverage for theft or vandalism by guests.

- Liability insurance: Liability coverage protects hosts if a guest or third party is injured on the property and files a claim for medical expenses or other damages. This coverage includes legal defense costs and settlements if the host is found liable.

- Loss of income coverage: If the property becomes uninhabitable due to covered damage, loss of income coverage helps compensate for lost rental revenue during the repair period. This ensures hosts may maintain their income stream even if the property is temporarily out of service.

- Guest injury protection: This coverage provides financial protection if a guest is injured on the property. It covers medical expenses and legal costs associated with the injury, helping to shield hosts from significant financial losses.

- Accidental damage protection: Accidents happen, and this coverage addresses accidental damage caused by guests, such as spills, stains, or broken items that may not be covered under general property damage protection.

- Additional living expenses coverage: If the property is uninhabitable due to a covered loss, this coverage helps pay for alternative accommodations for both the host and the guests, minimizing disruption to rental operations.

- Host protection insurance: This specialized coverage extends additional protection to hosts, including coverage for legal fees and settlements if a guest sues over issues related to the rental experience.

What factors affect the cost of VRBO insurance in Colorado?

Several factors can affect the cost of VRBO insurance in Colorado, including:

- Property Location: The location of the property plays a significant role. Properties in high-risk areas, such as those prone to wildfires, flooding, or avalanches, may have higher insurance premiums.

- Property Size and Value: Larger or more expensive properties typically require higher coverage limits, leading to increased premiums.

- Rental Frequency: The more frequently a property is rented out, the higher the risk of damage or liability claims, which can increase insurance costs.

- Type of Coverage: Comprehensive coverage, which includes property damage, liability, loss of rental income, and other endorsements, will be more expensive than basic policies.

- Amenities and Features: Properties with features like swimming pools, hot tubs, or fireplaces may pose higher risks, leading to higher premiums due to potential liability or maintenance costs.

- Security Measures: Properties with safety features like security systems, smoke detectors, and fire extinguishers may qualify for discounts, lowering the insurance cost.

- Claims History: Owners with a history of filing insurance claims may be viewed as higher-risk and could face higher premiums.

- Occupancy and Guest Profile: Insurance providers may consider the typical occupancy and the type of guests the property attracts (e.g., families vs. larger groups of tourists) when determining risk levels and pricing.

- Liability Limits and Deductibles: Higher liability limits or lower deductibles increase the overall cost of the insurance policy.

How does VRBO insurance differ from homeowners insurance?

VRBO insurance differs from homeowners insurance in several key ways:

- Coverage for rental activities: Homeowners insurance typically excludes coverage for rental activities or short-term rentals. VRBO insurance, on the other hand, is specifically designed to cover the risks associated with renting out a property to guests, including property damage, liability claims, and loss of income.

- Liability coverage: VRBO insurance provides higher liability limits and specific protections for guest injuries or damages caused by guests. Homeowners insurance may not provide adequate liability coverage for rental activities, leaving gaps in protection.

- Income loss protection: One of the key benefits of VRBO insurance is its coverage for lost rental income if the property becomes uninhabitable due to a covered loss. Homeowners insurance generally does not include this type of protection, which is critical for hosts relying on rental income.

- Host-specific protections: VRBO insurance often includes host-specific coverages, such as host protection insurance, which shields property owners from lawsuits or liability claims arising from guest-related incidents.

How does VRBO insurance differ from renters insurance?

VRBO insurance differs from renters insurance in several key ways:

- Purpose and coverage: VRBO insurance is designed for property owners renting out their homes to short-term guests, covering risks like property damage, liability claims, and loss of rental income. Renters insurance, however, is meant for tenants and covers personal belongings and liability for injuries within the rental unit, but not the property structure or rental income.

- Liability coverage: VRBO insurance offers liability protection specifically for guest-related incidents, such as injuries or damage caused by tenants, while renters insurance protects tenants from liability if someone is injured in their rental or they cause accidental damage.

- Property coverage: VRBO insurance focuses on protecting the physical property and any damage caused by guests, whereas renters insurance covers a tenant’s personal property like furniture or electronics, excluding the actual building structure.

- Income loss protection: A key aspect of VRBO insurance is coverage for lost rental income if the property becomes uninhabitable. Renters insurance does not provide income loss protection, as it is designed to protect personal property and tenant liability only.

How can property owners obtain VRBO insurance in Colorado?

Reach out to the independent agents at DeLuca Agency for a fast quote on VRBO insurance in Colorado and protect your rental property with the coverage it deserves. Our experienced team understands the unique needs of short-term rental hosts and will work with you to find the right insurance solutions tailored to your specific property and rental operations. With the right VRBO insurance in place, you may rent out your home with confidence, knowing that your property, income, and guests are protected.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com