BISA Specialized Insurance for Fire and Water Restoration Contractors Insurance in Colorado

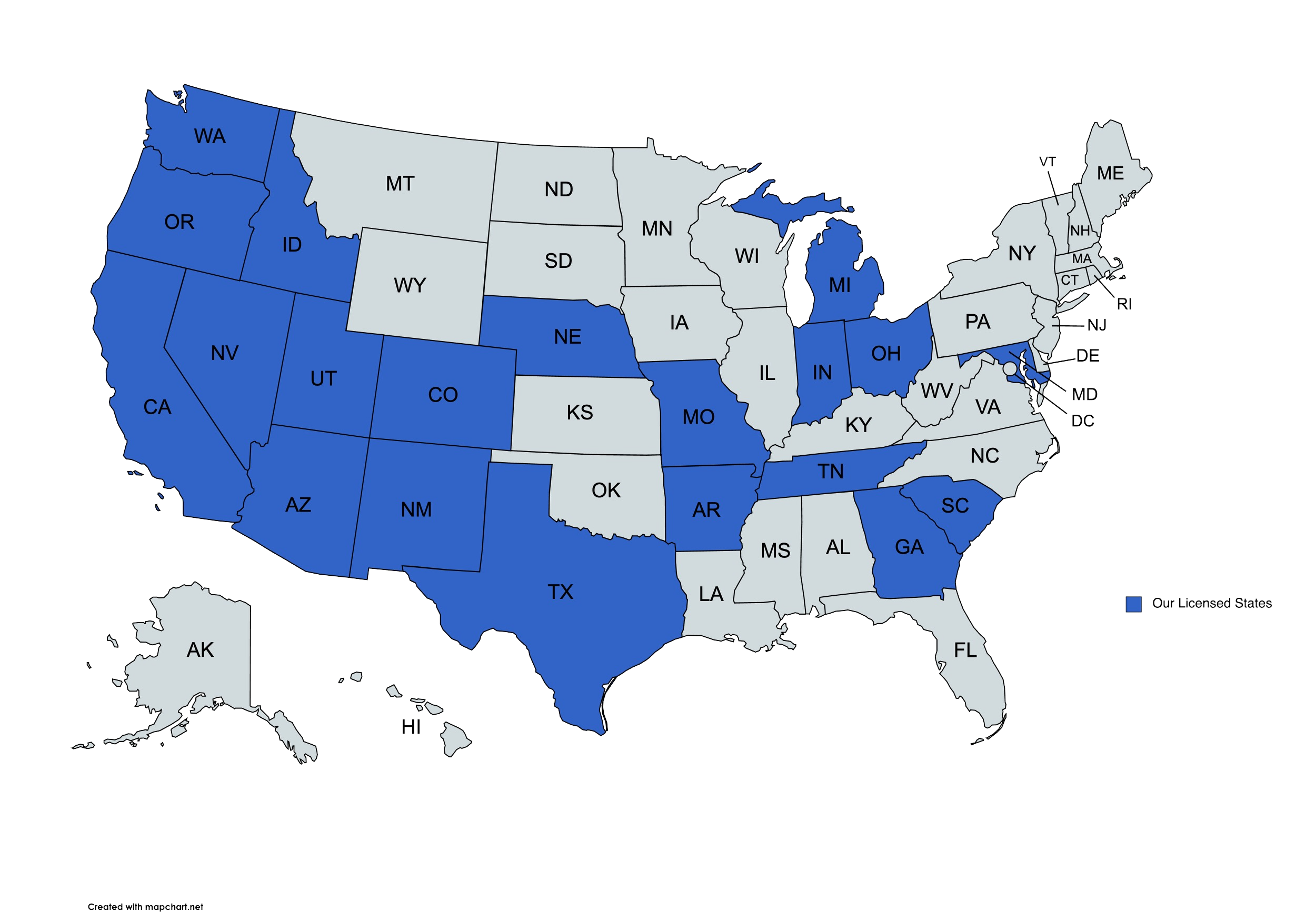

We provide fire and water restoration contractors insurance solutions to businesses in Colorado and beyond.

BISA Specialized Insurance for Fire and Water Restoration Contractors Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

At The DeLuca Agency, we understand that running a fire and water restoration business in Colorado comes with unique challenges. From emergency response to property restoration, your work is essential—but it also carries specific risks. That’s why we offer access to BISA Specialized Insurance tailored to the needs of fire and water restoration contractors like you.

Whether you’re dealing with smoke damage cleanup in Denver or water mitigation services in Fort Collins, we can help connect you with insurance options designed with your business in mind.

What is BISA Specialized Insurance?

BISA (Building Industry Services Association) Specialized Insurance is designed with the specific needs of the restoration industry in focus. It can help provide coverage options that address the exposures fire and water restoration contractors commonly face in their daily operations.

Unlike more general business insurance policies, BISA-backed plans may be crafted with insights from professionals who understand the complexities of mold remediation, fire cleanup, and water extraction. Working with The DeLuca Agency means you gain access to this specialized coverage network—backed by industry-specific experience and a local Colorado perspective.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

Who Needs This Type of Insurance in Colorado?

If you operate a fire and water restoration business in Colorado, this type of insurance may be a good fit. Restoration contractors work in unpredictable environments and handle hazardous materials, damaged properties, and time-sensitive repairs.

Companies that may benefit include:

- Water extraction and drying service providers

- Mold remediation contractors

- Smoke and soot cleanup professionals

- Structural drying technicians

- Full-service disaster restoration firms

Regardless of whether your operation is based in Colorado Springs, Boulder, or a smaller town like Durango, your business could benefit from exploring specialized insurance options.

What Types of Coverage Could Be Available?

While policy details vary depending on the provider and the specific risks of your business, some of the coverage options available through BISA Specialized Insurance may include:

- General Liability Insurance: Helps address third-party bodily injury or property damage claims.

- Contractors Pollution Liability: May offer protection related to mold, mildew, and other pollutants encountered during cleanup.

- Professional Liability Insurance: Can help with claims arising from errors in service or oversight during restoration work.

- Commercial Auto Insurance: For the trucks and vans used to transport equipment and crews across Colorado job sites.

- Tools and Equipment Coverage: Helps protect your essential gear from loss or damage.

- Workers’ Compensation Insurance: May be required by the state and can provide support in the event of employee injuries.

Keep in mind that coverage needs vary depending on your business operations. We can help you review your exposures and explore options that fit your goals.

Why Work With The DeLuca Agency for Your Restoration Business Insurance?

As a Colorado-based agency, we understand the landscape you’re operating in—both literally and professionally. The DeLuca Agency has experience working with restoration contractors throughout the state, from mountain towns to urban centers. Our focus is helping you find options that suit your operation size, scope, and risk level.

We’re not a one-size-fits-all shop. When you work with us, we take time to understand your business model, project types, and service areas. From there, we help you connect with BISA Specialized Insurance offerings that are aligned with your needs.

How Does The Process Work?

Getting started is simple. When you reach out to The DeLuca Agency, you’ll speak with a licensed Colorado insurance professional who understands the restoration industry. Here’s what you can expect:

- Initial Consultation – We discuss your business operations and any current coverage you may have in place.

- Needs Assessment – We identify key risks associated with your services and areas of operation.

- Policy Options Review – You’ll receive information on BISA and other insurance options that may align with your risk profile.

- Coverage Placement – If you decide to move forward, we’ll help facilitate your policy setup and answer any questions you have along the way.

We’re here to support you throughout the life of your policy, including renewals, adjustments, and claims assistance.

What Makes BISA Insurance Different?

BISA Specialized Insurance isn’t just a general policy with a new name. It’s a program developed specifically with restoration contractors in mind. Many traditional business insurance policies don’t fully consider the unique exposures faced when handling smoke, fire, and water damage restoration.

The BISA network works with carriers who understand these risks and are prepared to offer customized options. This could lead to more relevant policy features and potential cost efficiencies based on how your business operates.

Can You Help With Compliance and Licensing in Colorado?

Yes, we can guide you through understanding Colorado’s insurance requirements for contractors. This includes assistance with general liability thresholds, workers’ compensation mandates, and any bonding requirements based on your specific service offerings.

Because these requirements can vary by city or county within the state, our local knowledge can help ensure you stay in good standing with regulators and clients alike.

How Do I Get More Information?

If you’re looking for a BISA Specialized Insurance for fire and water restoration contractors and you’re operating anywhere in Colorado, we invite you to reach out for a no-obligation consultation. Our team at The DeLuca Agency is here to help you explore insurance options and find coverage that fits your business.

You can call us directly, use our online quote request form, or stop by our office. We’re proud to support the hardworking restoration professionals who help Colorado communities recover after disaster strikes.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

13894 Bangerter Pkwy Ste 200 Draper, UT 84020

Phone: 810.639.0078

Email: steve@delucaagency.com