Cyber Insurance in Colorado

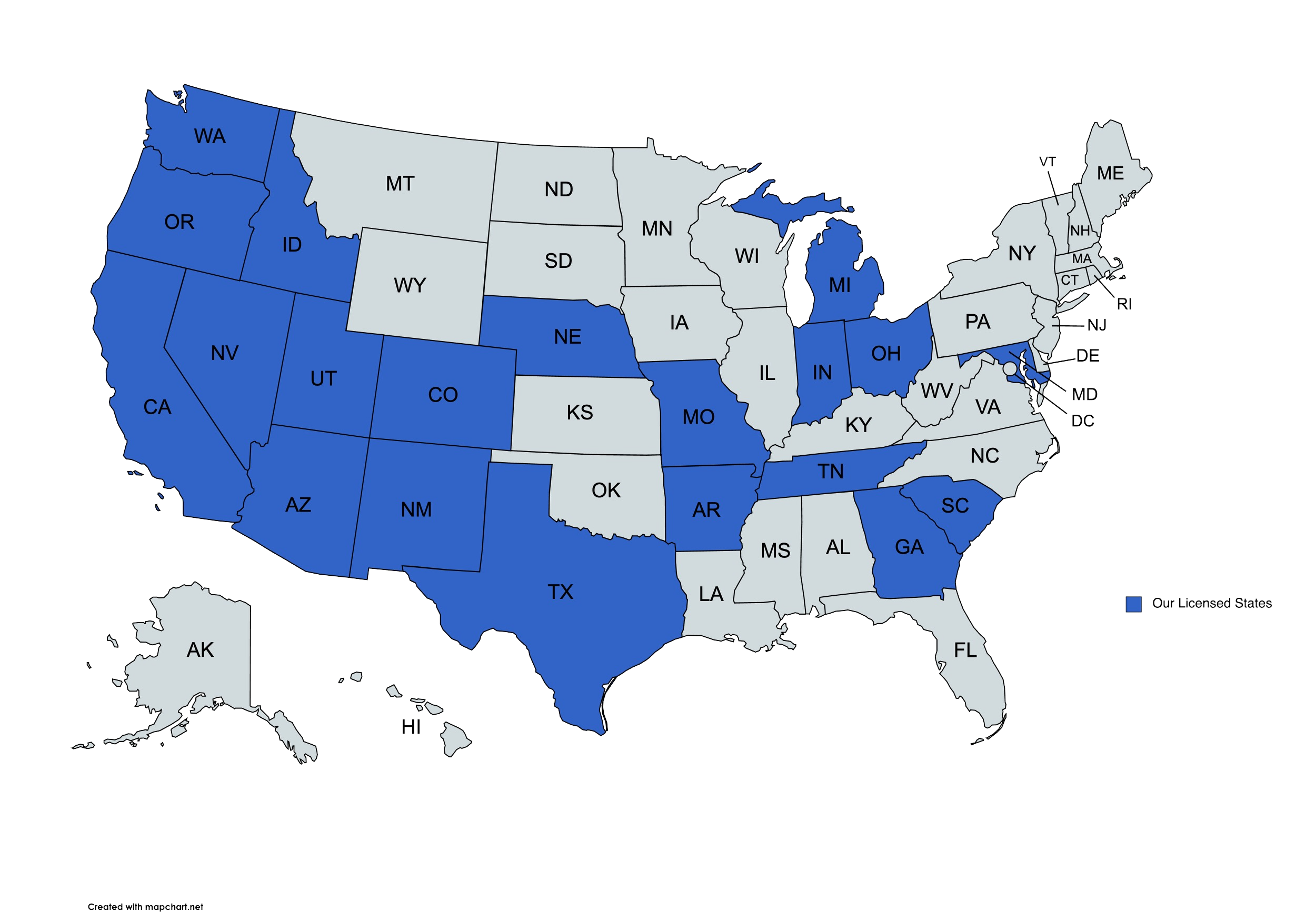

We provide Cyber Insurance solutions to businesses in Colorado and beyond.

Cyber Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

In today’s connected world, even the smallest business can face major risks online. The DeLuca Agency understands that digital threats are not just a concern for large corporations — they’re a daily reality for companies of every size across Colorado and beyond.

Our cyber insurance solutions are designed to safeguard your business from costly data breaches, network disruptions, and privacy violations so you can focus on what you do best: running your business.

What Is Cyber Insurance and Why Does It Matter?

Cyber insurance is a specialized form of coverage that helps protect your business from the financial fallout of digital incidents. These may include data breaches, ransomware attacks, phishing scams, or even employee errors that lead to lost or stolen data.

In many cases, a single cyber incident can cost thousands — or even millions — in recovery, legal fees, and reputation repair. Cyber insurance helps you absorb those costs, providing a safety net that may include data restoration, customer notification, regulatory compliance assistance, and business interruption coverage.

At The DeLuca Agency, we help simplify this complex protection. We’ll work with you to identify your risks and customize a policy that fits your business’s specific exposure and technology needs.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

How Can Cyber Insurance Help Colorado Businesses Stay Resilient?

Colorado’s economy thrives on innovation — from small startups in Boulder to established companies in Denver and Colorado Springs. But as businesses adopt more digital tools, they also become more vulnerable to cybercrime.

Cyber insurance from The DeLuca Agency helps Colorado companies stay resilient by ensuring that an online attack doesn’t derail years of hard work. Our coverage may include protection for data recovery, liability claims, cyber extortion, and income loss caused by system outages.

We also provide expert guidance on cyber best practices, helping your organization strengthen its defenses and minimize risks. With The DeLuca Agency, Colorado businesses can feel confident knowing they have both prevention and protection on their side.

What Types of Losses Does Cyber Insurance Typically Cover?

Every cyber policy is a bit different, but most include two main categories of protection: first-party and third-party coverage.

First-party coverage helps with the direct costs your business faces after a cyber incident — such as restoring data, investigating the breach, hiring forensic IT experts, or notifying affected customers. It may also cover lost revenue if your systems go down and you can’t operate normally.

Third-party coverage, on the other hand, helps if others — such as customers, vendors, or partners — sue your company for failing to protect their information. This may include legal defense, settlements, and court fees.

The DeLuca Agency can help you understand these categories and determine what mix of coverage makes sense for your situation.

Why Choose The DeLuca Agency for Cyber Insurance in Colorado?

Choosing the right cyber insurance partner is as important as the policy itself. The DeLuca Agency has served Colorado businesses for years with integrity, personal attention, and an understanding of the unique challenges our state’s industries face — from healthcare and education to tech startups and professional services.

We don’t just sell insurance; we help you build confidence in your digital operations. Our local team combines deep insurance expertise with a practical approach to risk management. Whether you’re in Denver, Fort Collins, Pueblo, or anywhere across Colorado, we’re ready to help you protect your data, your people, and your reputation.

What Kinds of Businesses Can Benefit Most from Cyber Coverage?

Any business that uses computers, stores data, or relies on the internet can benefit from cyber insurance — which means almost everyone. Still, some industries face particularly high risk.

If you handle customer data, such as names, addresses, or payment details, you’re vulnerable to data breaches. If you store sensitive records (for instance, in healthcare, law, or accounting), a hack could trigger costly compliance issues. And if your company depends on online systems for sales or operations, a cyberattack could halt your revenue stream overnight.

The DeLuca Agency works with all kinds of organizations — from small local shops to multi-location companies — to find affordable protection tailored to their digital footprint and industry needs.

How Does The DeLuca Agency Customize Cyber Insurance Coverage?

No two businesses share the same digital risks. That’s why The DeLuca Agency takes a consultative approach, learning about your operations, systems, and data before suggesting coverage.

Your cyber insurance policy may include:

- Data breach response coverage, including forensic and notification costs

- Cyber extortion and ransomware protection

- Network interruption coverage for lost income during downtime

- Liability coverage for lawsuits related to privacy or data loss

- Public relations and crisis management support to rebuild trust

We also collaborate with insurers that understand emerging cyber threats and regulatory changes, helping ensure your policy stays relevant as risks evolve.

What Steps Can Colorado Businesses Take to Reduce Cyber Risk?

While cyber insurance provides a vital safety net, prevention is just as important. The DeLuca Agency encourages Colorado businesses to take proactive measures such as:

- Training employees to recognize phishing and social engineering scams

- Using multi-factor authentication and secure password practices

- Keeping software, firewalls, and antivirus tools updated

- Regularly backing up critical data and storing copies offline

- Conducting vulnerability assessments or penetration tests

When combined with a strong cyber insurance policy, these measures create a powerful defense against digital threats. And because The DeLuca Agency partners with leading cybersecurity specialists, we can connect you with trusted resources to strengthen your resilience even further.

How Can You Get Started with Cyber Insurance from The DeLuca Agency?

Protecting your business from cyber threats doesn’t have to be complicated. The DeLuca Agency makes it easy to get started with a friendly consultation — no pressure, just answers. We’ll review your current risk landscape, explain available coverages in plain language, and help you find a policy that fits your budget and comfort level.

Your data is valuable. Your customers trust you. Let us help you keep that trust intact with reliable cyber insurance designed for modern risks.

Reach out to The DeLuca Agency today to learn more about cyber insurance in Colorado — and take the first step toward stronger digital protection and peace of mind.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

2745 W 600 N Suite 500 Lindon UT 84042

Phone: 810.639.0078

Email: service@delucaagency.com