Durable Home Medical Equipment Retail Insurance in Colorado

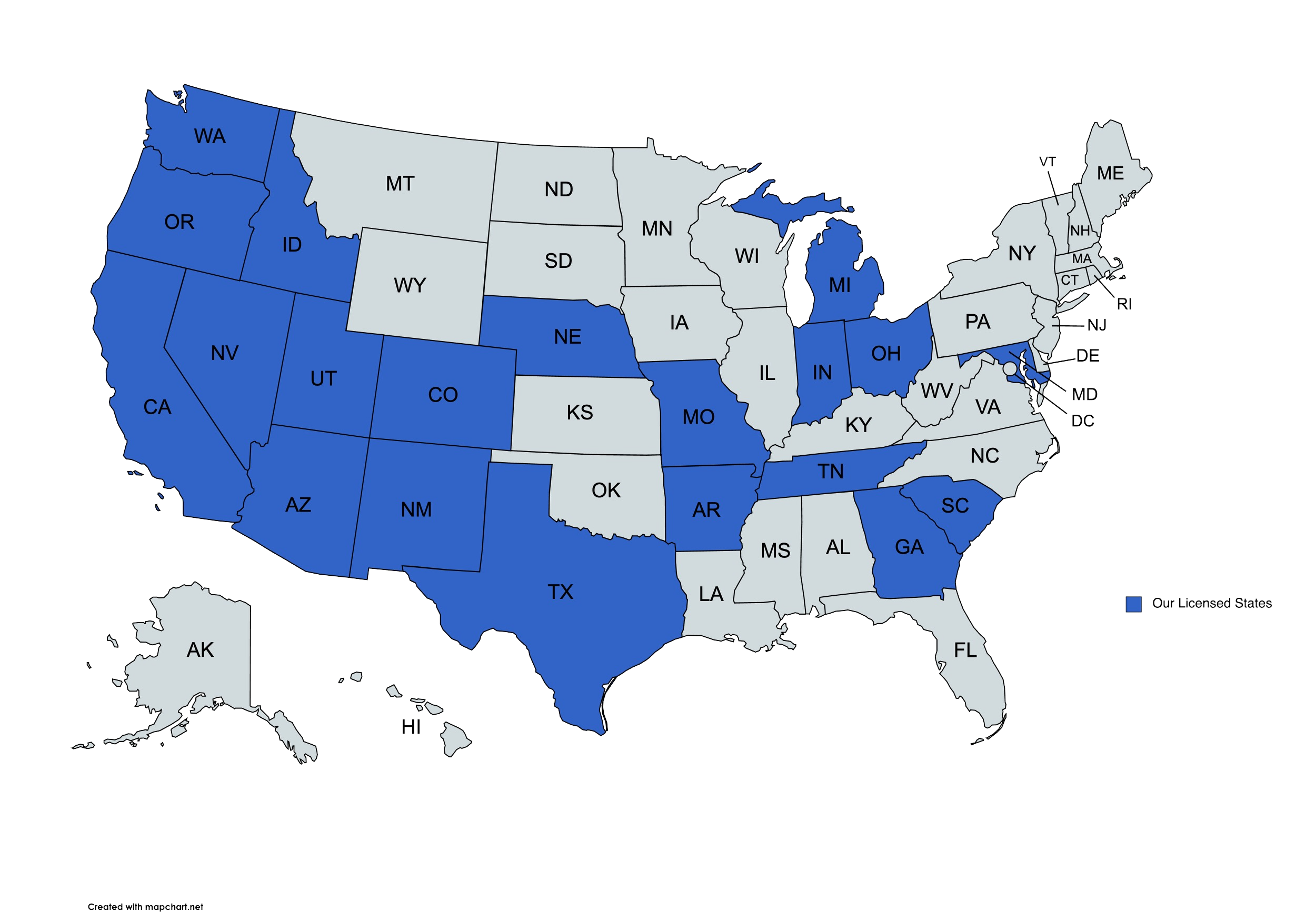

We provide durable home medical equipment retail insurance solutions to businesses in Colorado and beyond.

Durable Home Medical Equipment Retail Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

Running a durable home medical equipment retail business in Colorado comes with its unique risks and challenges. At The DeLuca Agency, we understand the complexities involved in protecting your business assets, employees, and customers. Our approach is designed to support Colorado businesses with insurance solutions tailored to the durable medical equipment retail industry.

What Is Durable Home Medical Equipment Retail Insurance?

Durable Home Medical Equipment Retail Insurance generally refers to insurance products that help protect businesses specializing in selling or renting medical equipment used in home care settings. This equipment may include items like wheelchairs, oxygen tanks, hospital beds, and mobility aids.

For businesses in Colorado, insurance can play a role in managing risks such as property damage, liability claims, and potential equipment malfunctions. While coverage options can vary, this type of insurance typically addresses the specific exposures faced by retailers in this specialized market.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

Why Might Durable Home Medical Equipment Retailers in Colorado Need Insurance?

Operating a durable home medical equipment retail business in Colorado involves handling expensive inventory and equipment that must be maintained and transported safely. Insurance can be an important consideration to help safeguard your business from financial setbacks related to:

- Property damage due to fire, theft, or natural events common in Colorado

- Liability claims stemming from customer injuries or equipment misuse

- Employee-related incidents and workers’ compensation concerns

- Business interruption during unforeseen events affecting operations

Insurance needs can differ widely based on business size, location, and specific services offered, so a customized approach is often essential.

How Does Location in Colorado Affect Insurance Considerations?

Colorado’s diverse climate and geography can influence the types of risks your business might face. For example, areas prone to wildfires, hailstorms, or heavy snowfall may require more detailed risk management strategies. Additionally, local laws and regulations impacting medical equipment retailers can affect insurance requirements or recommendations.

Working with an agency familiar with Colorado’s environment and regulatory landscape can help ensure that your business is better prepared for regional challenges.

What Types of Coverage Are Commonly Needed for Durable Home Medical Equipment Retailers?

Durable home medical equipment retailers encounter various risks, which calls for the following coverage:

- Property Damage: Damage to inventory, equipment, or storefronts caused by accidents or environmental factors.

- Product Liability: Risks linked to equipment failure or malfunction that could potentially cause injury or harm to users.

- General Liability Insurance: Claims related to slips, falls, or injuries occurring on business premises.

- Cyber Insurance: Risks associated with the handling and storage of sensitive customer health information.

- Workers’ Compensation Insurance: Employee injuries during loading, unloading, or maintenance activities.

Understanding these risks helps in tailoring insurance solutions that address the specific exposures your business faces.

What Should You Consider When Choosing Insurance for Your Durable Home Medical Equipment Retail Business?

When selecting insurance in Colorado, several factors may influence your decisions:

- Business Size and Scope: The range of equipment offered and the size of your operation may impact the types and amounts of coverage suitable for your business.

- Customer Base: Serving different customer segments, such as individuals or healthcare facilities, may require varied protection.

- Delivery and Service Models: Whether your business offers delivery, installation, or equipment repair can add layers of risk.

- Regulatory Requirements: Ensuring compliance with Colorado and federal regulations related to medical equipment and healthcare privacy is important.

Careful consideration of these elements can help in identifying coverage options that align with your business needs.

How Can The DeLuca Agency Assist Colorado Durable Home Medical Equipment Retailers?

At The DeLuca Agency, we focus on understanding the nuances of your business and the Colorado marketplace. We can guide you through the insurance landscape by:

- Assessing your unique business risks and exposures

- Offering insight into potential insurance solutions relevant to your durable home medical equipment retail operations

- Connecting you with carriers that have experience with similar businesses in Colorado

- Providing ongoing support as your business grows or changes

Our goal is to help you make informed decisions about protecting your investment, employees, and customers.

Are There Special Considerations for Durable Home Medical Equipment Insurance in Colorado?

Yes, certain factors may be especially relevant for businesses operating in Colorado, including:

- Natural Disaster Risks: Preparing for wildfires, floods, and severe weather events can influence insurance needs.

- Regulatory Compliance: Adhering to Colorado-specific medical equipment regulations and healthcare data protection laws.

- Equipment Maintenance: Ensuring proper servicing and safety checks to reduce liability.

- Customer Safety: Implementing training and protocols to minimize risks associated with equipment use.

These considerations often impact how insurance programs are structured and tailored.

How Do Insurance Policies Typically Address Durable Medical Equipment Retail Businesses?

Insurance policies for this industry may include various components like general liability, property coverage, product liability, and workers’ compensation. Some policies may also offer specialized endorsements or riders to cover specific equipment or operational risks.

While each business is unique, policies often aim to provide financial protection against claims or losses that could interrupt operations or impact profitability.

What Steps Can You Take to Protect Your Durable Home Medical Equipment Business Beyond Insurance?

Insurance can be an important part of risk management, but additional measures can further reduce vulnerabilities, such as:

- Implementing strong safety protocols and employee training programs

- Regular equipment inspections and maintenance schedules

- Maintaining detailed records for compliance and operational transparency

- Developing a disaster preparedness and business continuity plan

Combining these efforts with appropriate insurance coverage helps create a more resilient business model.

How Do You Get Started With Durable Home Medical Equipment Retail Insurance in Colorado?

If you operate a durable home medical equipment retail business in Colorado, the first step is often a consultation with an experienced insurance agent who understands your industry and region. The DeLuca Agency can help you assess your needs, review potential risks, and explore insurance options tailored to your unique situation.

Contact us today to discuss how we can support your business with insurance solutions designed for Colorado’s durable home medical equipment retail market.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

2745 W 600 N Suite 500 Lindon UT 84042

Phone: 810.639.0078

Email: service@delucaagency.com