HOA Insurance in Colorado

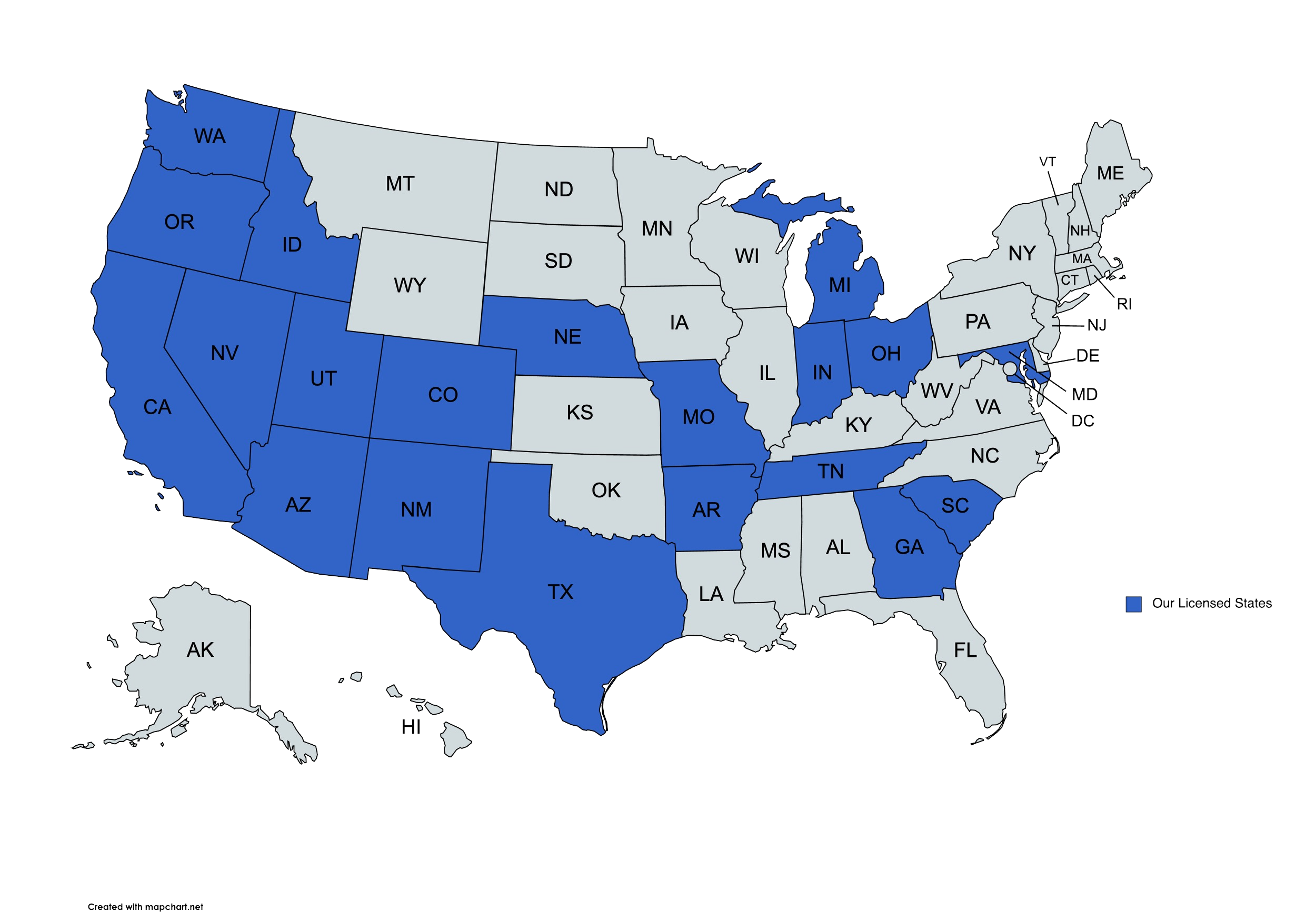

We provide HOA Insurance solutions to businesses in Colorado and beyond.

HOA Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

Homeowners associations across Colorado operate in some of the country’s most dynamic environments—blending mountain weather, urban growth, and diverse property styles. With so many variables, one unexpected event can create a financial strain for board members and homeowners alike. That’s where The DeLuca Agency comes in.

Our team understands that every HOA is unique. A condominium community in Denver may face different exposures than a single-family development in Colorado Springs or a mixed-use property near Boulder. That is why we help associations secure insurance programs that may include protection for buildings, common areas, board members, liability, and more.

By tailoring coverage to the community’s needs, we help HOAs stay compliant, financially secure, and prepared for the unexpected. If your association is seeking reliable guidance from a knowledgeable, Colorado-focused agency, you’ll find a trusted partner in The DeLuca Agency.

How Can HOA Association Insurance Protect Your Community in Colorado?

A strong HOA association insurance program is designed to help protect both the association’s assets and the financial well-being of the homeowners it serves. Because HOAs carry responsibility for roofs, shared structures, landscaping, amenities, and community operations, one claim can affect everyone.

Coverage may include options such as:

- Protection for shared buildings and structures

- Liability coverage for accidents on common property

- Optional enhancements like cyber liability or equipment breakdown

- Certain protections for storm, fire, or vandalism-related damage

The DeLuca Agency helps you understand what is covered, what gaps may exist, and how to create a balanced plan that aligns with your bylaws and budget. Our goal is to make insurance feel like a reliable foundation—not a confusing contract.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

Which Colorado HOA Insurance Coverages May Be Right for Your Association?

Selecting the right Colorado HOA insurance package requires understanding your community’s property type, construction details, and responsibilities outlined in your governing documents. Multi-story condo buildings may need broader structural coverage, while townhouse communities might primarily focus on common areas and liability protection.

Your policy may include coverage for roofs, exterior structures, clubhouses, fences, pools, signage, lighting systems, or garages. Additional liability coverage can help protect the association if a guest is injured on shared property or if the board faces an allegation of mismanagement.

At The DeLuca Agency, we guide boards through the nuances of master policy requirements and help identify which coverages fit your risk profile. We never push a one-size-fits-all plan—our approach is built on local insight and thoughtful evaluation.

Why Should HOA Boards Consider Directors and Officers Insurance?

Board members make important decisions every day—approving budgets, managing vendors, enforcing rules, and addressing homeowner concerns. Even with the best intentions, disagreements or misunderstandings can escalate quickly. Directors and Officers (D&O) Insurance is designed to help protect board members from claims alleging poor decisions, discrimination, misuse of funds, failure to enforce bylaws, and other governance disputes.

D&O policies may include features such as:

- Legal defense for board-related allegations

- Coverage for settlements or judgments

- Protection for both current and former board members

The DeLuca Agency helps boards evaluate appropriate limits, understand the difference between occurrence and claims-made coverage, and select a policy that aligns with modern HOA risks. It’s a smart way to keep leadership confident and the community running smoothly.

How Does Liability Insurance Help Safeguard Shared Spaces?

Every community has areas where residents gather, walk, play, or utilize shared infrastructure. These spaces—whether a fitness room, playground, walking path, or parking area—carry natural liability exposure. If someone is injured or property is damaged, the association could be held responsible.

General liability insurance helps provide financial protection for these scenarios. It may include medical payments, legal defense, and settlements depending on the nature of the incident. Some communities may also benefit from umbrella liability coverage, which provides an additional layer of protection above standard policy limits.

The DeLuca Agency evaluates the layout and features of your common areas to help ensure your coverage makes sense for the way residents actually use your property. The result is an HOA that is both welcoming and well-protected.

What Property Coverages Should Colorado HOAs Consider for Structural Protection?

Colorado communities face varied environmental challenges—from hailstorms and heavy snow to high winds and intense sun exposure. These conditions can take a toll on buildings, roofs, and shared structures. That’s why Colorado HOA property insurance is essential for safeguarding the physical assets of your association.

Property coverage may include protection for exterior walls, hallways, elevators, mechanical systems, clubhouses, gazebos, and community-owned equipment. Policies can also be structured to cover replacement cost or actual cash value, depending on your risk tolerance and budget.

The DeLuca Agency reviews construction details, roof ages, and maintenance considerations to help determine appropriate limits. Whether your community includes large buildings or modest common areas, we build a coverage strategy that supports resilience and long-term property value.

How Can The DeLuca Agency Support Your HOA’s Long-Term Insurance Strategy?

Insurance is not a “set it and forget it” decision—especially for homeowners associations where property values, membership, and local regulations evolve over time. The DeLuca Agency provides ongoing support that may include annual policy reviews, claims guidance, budget planning help, and updates based on regulatory changes or community growth.

We work closely with HOA boards and property managers to stay proactive rather than reactive. Our team explains coverage clearly, answers board questions, and makes recommendations that support your long-term financial stability.

With a strong understanding of both HOA operations and Colorado market conditions, we help associations secure dependable protection year after year. Reach out to The DeLuca Agency today to schedule a consultation and see how we can support your HOA’s insurance strategy.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

2745 W 600 N Suite 500 Lindon UT 84042

Phone: 810.639.0078

Email: service@delucaagency.com