Nonprofit Insurance in Colorado

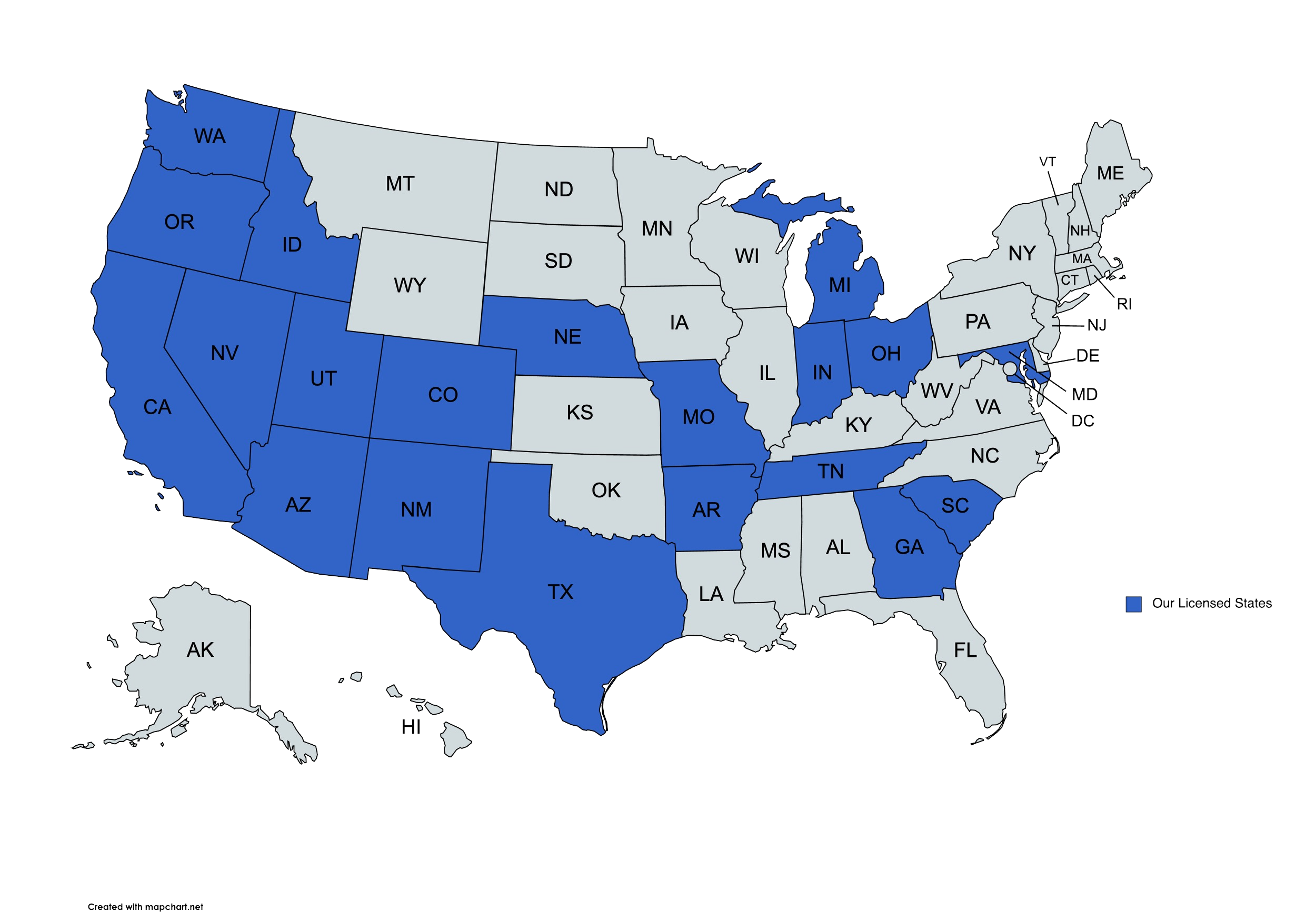

We provide nonprofit insurance solutions to businesses in Colorado and beyond.

Nonprofit Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

Running a nonprofit organization comes with a unique set of responsibilities and risks. From board member decisions to volunteer mishaps, the potential for liability is always present. At The DeLuca Agency, we help nonprofit leaders in Colorado navigate these challenges with tailored insurance options designed to meet their needs and support their missions.

What Is Nonprofit Insurance?

Nonprofit insurance is a term used to describe a group of policies that help protect organizations from various financial risks. These may include liability claims, property damage, employment-related disputes, and allegations of mismanagement. For nonprofits in Colorado, insurance can play a critical role in ensuring that an unexpected event doesn’t derail your operations or jeopardize your mission.

The right nonprofit insurance policy typically offers flexibility depending on the size of your organization, the services you provide, and the people you work with, such as volunteers, board members, and donors. The DeLuca Agency works with Colorado-based nonprofits of all sizes to explore options that fit their scope of work.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

Why Do Colorado Nonprofits Need Liability Insurance?

Liability insurance may help provide financial protection if your nonprofit is held responsible for injuries, property damage, or other covered claims. For example, if a volunteer is injured at an event or someone files a lawsuit claiming discrimination or wrongful termination, nonprofit liability insurance could help cover legal defense costs and potential settlements.

Nonprofit liability insurance is not just about defending lawsuits. It’s also about building trust with your board, donors, and community by showing that you take risk management seriously. In Colorado’s often unpredictable legal and regulatory environment, having this kind of coverage in place may offer peace of mind for everyone involved.

What Types of Liability Coverage Might Be Available for Nonprofits?

Several types of nonprofit liability insurance may be relevant depending on your organization’s structure and activities. Here are a few examples:

- General Liability Insurance – May help cover third-party bodily injury or property damage claims, such as a slip-and-fall at your facility.

- Directors and Officers (D&O) Insurance – This coverage is often recommended to help protect your board members and leadership team from allegations of wrongful acts, such as misuse of funds or decisions that result in financial loss.

- Employment Practices Liability Insurance (EPLI) – May assist with claims related to hiring and employment practices, such as harassment, wrongful termination, or discrimination.

- Professional Liability Insurance – If your nonprofit provides advice, counseling, or similar services, this may help cover claims that allege negligence or professional errors.

Each nonprofit is different, and the needs of a youth mentoring program in Denver may differ from a food bank in Pueblo. At The DeLuca Agency, we work with Colorado nonprofits to assess which types of liability insurance are appropriate for their unique risks.

Who Needs Nonprofit Liability Insurance in Colorado?

Most nonprofit organizations in Colorado, regardless of their size or purpose, can benefit from liability insurance. This includes:

- Charitable and faith-based organizations

- Educational nonprofits

- Arts and culture institutions

- Environmental and conservation groups

- Health and human services programs

- Foundations and grant-making entities

Even if your nonprofit doesn’t own property or have employees, it could still be exposed to liability risks through volunteer activities, events, or digital communications. Liability insurance is often a smart step for organizations looking to secure grants, rent space, or simply demonstrate sound governance.

How Is Nonprofit Insurance Customized for Colorado Organizations?

Colorado nonprofits operate within a unique legal and environmental landscape. The state’s varying weather conditions, urban-rural dynamics, and active volunteer culture all influence the types of risks organizations may face.

The DeLuca Agency understands these local nuances. Whether your nonprofit is hosting fundraisers in Boulder, managing volunteers in Grand Junction, or supporting community health in Colorado Springs, we’re here to explore coverage options that reflect your operational realities.

Customization may include:

- Reviewing your programs and service areas

- Considering volunteer and staff exposures

- Addressing state-specific employment laws

- Accounting for property ownership or leased spaces

We’ll guide you through potential options and help you ask the right questions to make informed decisions.

How Can The DeLuca Agency Help?

The DeLuca Agency is based right here in Colorado and brings years of experience working with nonprofits across the state. Our team is committed to supporting organizations that serve others and we understand that every dollar counts.

Here’s what you can expect when you work with us:

- Consultative Approach – We start by listening. Your mission and operations help shape the options we explore.

- Local Expertise – We’re familiar with the legal and environmental issues that nonprofits in Colorado often face.

- Flexible Options – From startup nonprofits to established foundations, we can help tailor policies that reflect your needs.

- Ongoing Support – Insurance needs can evolve as your organization grows. We’re here to help you reassess coverage and answer questions any time.

What Should You Consider When Shopping for Nonprofit Insurance?

When evaluating nonprofit insurance options in Colorado, it’s helpful to consider:

- The size of your organization and number of people involved

- Whether you own, lease, or operate in physical spaces

- How much of your work involves volunteers or contractors

- The types of services or support you provide to the public

- Any past claims or legal disputes

- Compliance requirements from funders or government partners

Working with an agency that understands the nonprofit sector can make this process clearer and more effective. We’ll walk you through what to look for in policy language, how to identify potential gaps, and what to keep in mind as your organization changes.

Ready to Learn More About Nonprofit Insurance in Colorado?

Your nonprofit plays a critical role in your community. With the right insurance in place, you can keep your focus where it belongs: on your mission. Whether you’re just starting out or looking to reevaluate your coverage, The DeLuca Agency is here to help.

Reach out today for a personalized consultation. Let’s explore how nonprofit liability insurance could help support your work in Colorado.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

2745 W 600 N Suite 500 Lindon UT 84042

Phone: 810.639.0078

Email: service@delucaagency.com