Private Ambulance Insurance in Colorado

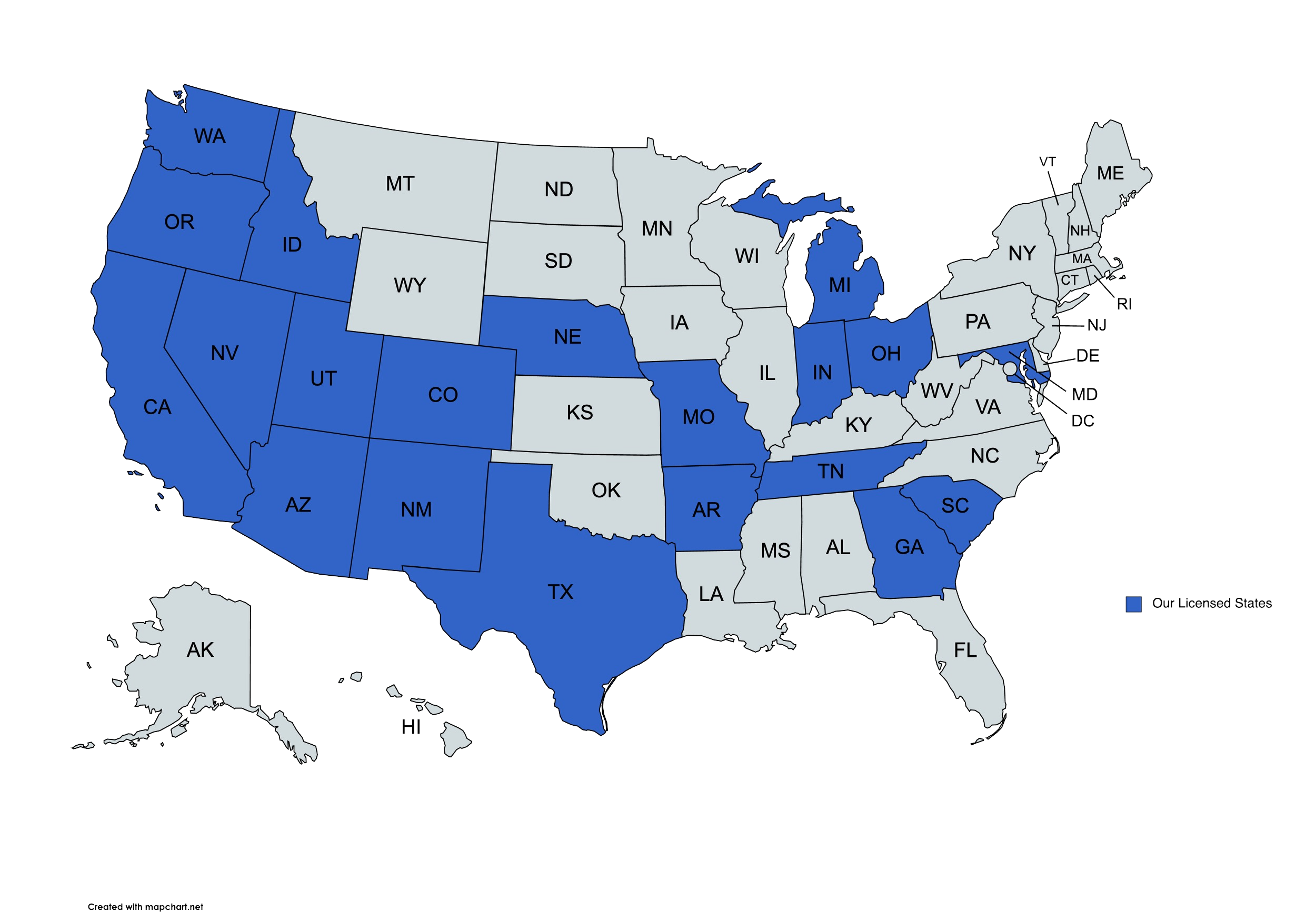

We provide Private Ambulance Insurance solutions to businesses in Colorado and beyond.

Private Ambulance Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

At The DeLuca Agency, we understand the unique risks and challenges faced by ambulance and medical transport services. Serving clients across Colorado, we provide specialized Private Ambulance Insurance designed to protect your business, your staff, and the patients you serve.

Our approach combines expert knowledge with a personalized touch, ensuring you have coverage tailored to your operations. Whether you’re a single-vehicle operation or a large fleet, we help you navigate complex insurance requirements so you can focus on what matters most: saving lives.

What Is Private Ambulance Insurance And Why Do You Need It?

Private Ambulance Insurance is a specialized form of coverage designed for companies that provide emergency and non-emergency medical transport. Unlike general business insurance, it specifically addresses the unique risks associated with patient care, vehicle operation, and liability exposure. Coverage may include protection for vehicles, drivers, passengers, medical equipment, and general liability claims.

Without proper insurance, ambulance operators face significant financial and legal risks. Accidents, equipment damage, or medical incidents can result in substantial costs that can jeopardize the future of your business. At The DeLuca Agency, we work with Colorado ambulance companies to ensure every aspect of their operation is protected. Our policies may include vehicle insurance, professional liability, worker’s compensation, and even cyber liability coverage for patient records.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

How Does The DeLuca Agency Tailor Coverage For Colorado Ambulance Services?

Operating an ambulance service in Colorado comes with unique considerations. The state’s mountainous terrain, unpredictable weather, and rural emergency calls can increase the likelihood of accidents or equipment damage. Our team at The DeLuca Agency understands these regional challenges and customizes insurance solutions accordingly.

Coverage may include vehicle collision and comprehensive protection, medical liability, equipment replacement, and employee injury protection. We assess your fleet size, routes, and service types to recommend policies that match your specific operational needs. By partnering with trusted carriers, we ensure you have access to competitive rates without sacrificing coverage quality. With our guidance, Colorado ambulance providers can focus on patient care while remaining fully protected.

What Types Of Risks Are Covered By Private Ambulance Insurance?

Private Ambulance Insurance addresses a wide range of operational risks. Common areas of coverage may include:

- Vehicle Damage: Protection against collisions, vandalism, or weather-related incidents.

- Medical Liability: Coverage for patient injuries or mishandling claims.

- Equipment Coverage: Replacement or repair of medical devices, stretchers, and monitors.

- Employee Protection: Worker’s compensation and liability for staff injuries during operations.

- General Liability Insurance: Third-party property damage or bodily injury claims.

At The DeLuca Agency, we take a proactive approach, identifying potential gaps in coverage before they become costly problems. Our goal is to give ambulance operators peace of mind knowing that all aspects of their business are safeguarded.

Why Choose The DeLuca Agency For Private Ambulance Insurance In Colorado?

Choosing the right insurance partner can make all the difference for your ambulance service. The DeLuca Agency combines local expertise with a commitment to client service, ensuring every policy is customized, transparent, and reliable. We work closely with carriers who understand the unique risks associated with ambulance operations, giving you access to specialized coverage that general business insurance may not offer.

Our clients value our thorough approach, which includes detailed risk assessments, regular policy reviews, and claims support when it matters most. By choosing The DeLuca Agency, Colorado ambulance providers gain a trusted advisor who prioritizes their long-term safety and operational stability.

How Can Private Ambulance Insurance Protect Your Employees And Patients?

Insurance for ambulance services isn’t just about protecting vehicles—it’s about protecting people. Policies may cover injuries sustained by staff while responding to emergencies, as well as liability claims related to patient care. This comprehensive protection allows you to operate confidently, knowing your team and the patients you serve are financially safeguarded.

Coverage may extend to occupational hazards, medical malpractice claims, or even unexpected incidents during non-emergency transports. By addressing both employee and patient risks, The DeLuca Agency ensures your Colorado ambulance service maintains compliance, minimizes liability exposure, and builds a reputation for safety and reliability.

What Should Colorado Ambulance Operators Look For In A Policy?

When evaluating Private Ambulance Insurance in Colorado, operators should consider coverage limits, exclusions, and optional add-ons that may suit their unique operations. Policies may include vehicle protection, liability coverage, and employee safeguards, but the exact combination should reflect your fleet size, service type, and risk profile.

The DeLuca Agency helps you identify essential coverage, avoid common pitfalls, and ensure compliance with state regulations. Our team explains each aspect of your policy in clear, jargon-free language so you understand exactly what is—and isn’t—covered. With our guidance, you can make informed decisions that protect both your business and your team.

How Do You Get Started With The DeLuca Agency?

Starting your journey toward comprehensive Private Ambulance Insurance in Colorado is simple. Begin by contacting The DeLuca Agency for a personalized consultation. We’ll review your operations, assess potential risks, and recommend a policy tailored to your needs.

From the first call to finalizing your coverage, we focus on clarity, responsiveness, and ensuring you feel confident in your insurance choices. Our team is here to answer questions, provide guidance, and handle claims support when necessary. With The DeLuca Agency, protecting your ambulance service has never been easier or more reliable.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

2745 W 600 N Suite 500 Lindon UT 84042

Phone: 810.639.0078

Email: service@delucaagency.com