Salon and Barber Insurance in Colorado

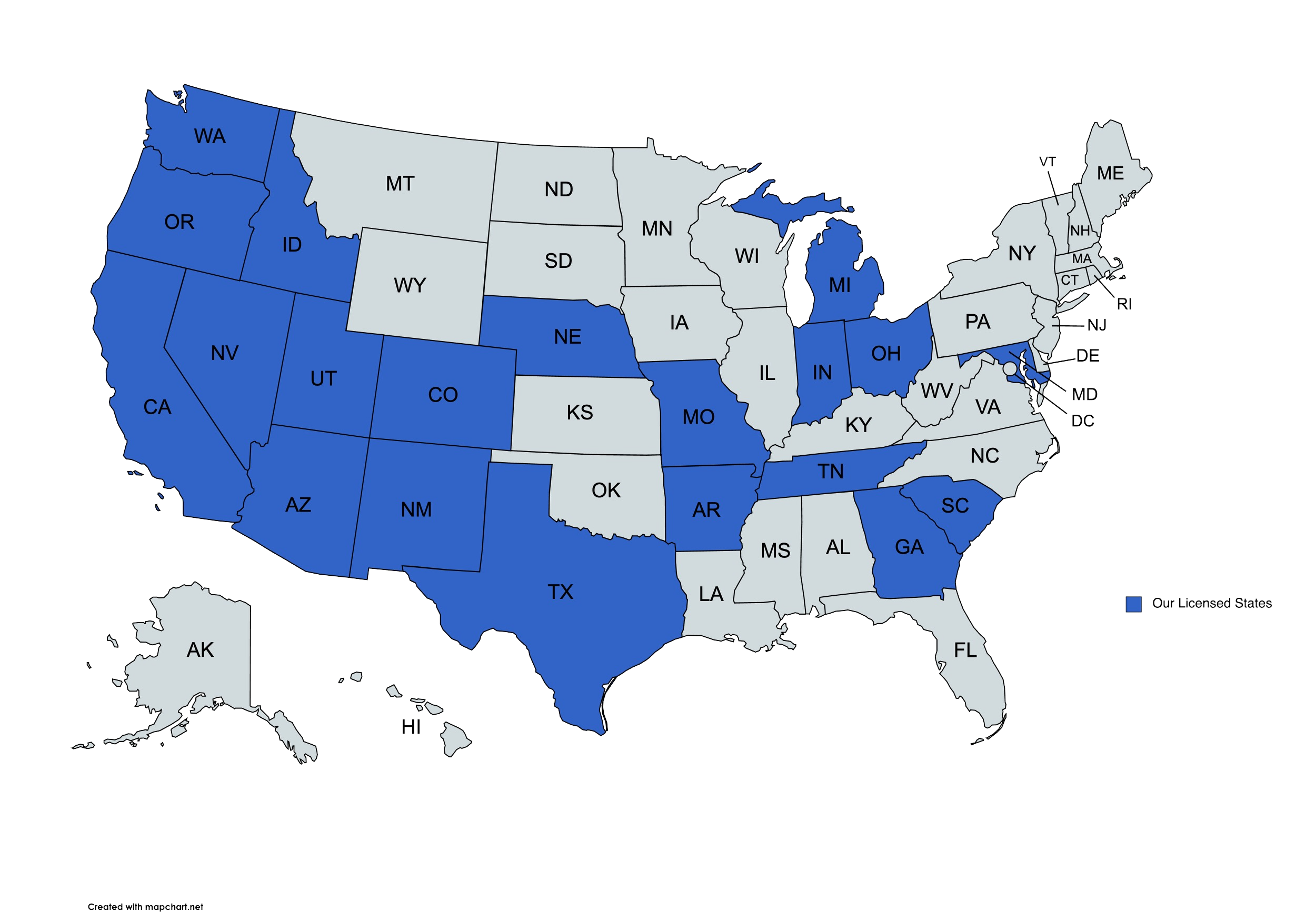

We provide Salon and Barber Insurance solutions to businesses in Colorado and beyond.

Salon and Barber Insurance at The DeLuca Agency and Denver Insurance Brokerage Inc

Running a salon or barbershop is more than styling hair—it’s about creating a space where clients feel confident and cared for. At the same time, owning a beauty or grooming business comes with unique risks that can’t be ignored. From slip-and-fall accidents to costly equipment breakdowns, the unexpected can happen anytime. That’s where The DeLuca Agency comes in. We specialize in salon and barber insurance tailored to the needs of stylists, barbers, and shop owners in Colorado and beyond.

Our goal is simple: to help protect your livelihood with the right coverage so you can focus on growing your business, building client relationships, and expressing your craft with peace of mind.

Why Do Salons And Barbers In Colorado Need Specialized Insurance?

While any small business faces risks, salons and barbershops encounter very specific challenges. You work closely with clients, use chemicals and heated tools, and maintain equipment that’s vital to your daily operations. Even the most careful professionals can face claims of allergic reactions, accidental cuts, or damaged property.

Colorado salon and barber businesses also need to consider regional risks like sudden winter storms that can close your shop or cause property damage. With specialized coverage, you won’t have to carry those financial burdens alone. The DeLuca Agency understands these industry-specific challenges and can help you build an insurance plan that fits your business size, services, and budget.

Get a Quote

“I became a client of the DeLuca Agency when it bought my previous insurance agency. Fortunately, Caula Campbell-Frazier transferred with the company. She has been a delight to work with–always responds quickly, thoroughly and with a real desire to answer questions or assist you. I can’t say enough good things about her. You will not be disappointed.”

“I worked with Caula Campbell to renew my homeowners insurance, she was able to help me by pointing out a gap in my coverage and still was able to lower my premiums. I am enjoying my lower mortgage as a result of the lower escrow. Highly recommend.”

“The agency did a great job on finding better rates for me. The staff is very professional and resourceful. Thanks!”

Spoke with Gloria and she was very knowledge about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.

Spoke with Gloria and she was very knowledgeable about my insurance needs. She guided me to consider options that are well within my budget and would greatly help my family when needed.Had a great experience with the DeLuca Agency. We quoted with them one year and decided not to move forward because life got busy. But we decided to try again the next year and we were welcomed back without judgment for not having moved forward previously. The agent (Paige Brown) was very professional and extremely knowledgeable about the various companies, coverage, etc. They are able to cater to high end clients and it shows with their knowledge, thoroughness, and expertise. She spent a good amount of time answering our complex questions and informed us about things we never knew before that go deeper into insurance coverage. They have a nice range of products as well and seem to do what’s best for your unique situation.

Paige with The DeLuca Agency was a great help when I needed insurance recently. Highly recommend.

I have worked with the DeLuca Agency since moving to CO in 2019. Danielle Duffy is amazing and has always helped me out with any and everything I have needed. She goes above and beyond every single time I contact her. Beyond that, she is just an overall pleasant person!

We have been insured through The DeLuca Agency for over 2 years and find their customer service highly responsive. The Staff is extremely professional and knowledgeable. I highly recommend this agency for any of your insurance needs.

What Types Of Coverage May Be Included In Salon And Barber Insurance?

Insurance for beauty and grooming professionals isn’t one-size-fits-all. Depending on your services, employees, and setup, your plan may include:

- General Liability Insurance – Protects against customer injury or property damage claims.

- Professional Liability Insurance – Covers situations where services may cause unintended harm, like a chemical burn from a coloring treatment.

- Commercial Property Coverage – Helps repair or replace tools, chairs, dryers, and other essential equipment.

- Business Interruption Coverage – Provides financial support if your salon or barbershop has to close temporarily due to a covered event.

- Workers’ Compensation Insurance – Supports employees if they get hurt on the job.

- Product Liability Insurance – Covers issues that arise from retail items you sell, like shampoos or styling products.

At The DeLuca Agency, we take time to learn about your shop’s operations and recommend flexible protection that evolves with your business.

How Can Insurance Protect Colorado Salon And Barber Shop Owners From Financial Risk?

A single incident could mean thousands in legal fees, medical bills, or repair costs. For example, imagine a client slipping on a wet floor and breaking a wrist, or a curling iron malfunction that causes damage to your space. Without the right insurance, these events could become overwhelming expenses.

Colorado salon and barber shop owners often juggle rent, payroll, product inventory, and marketing costs already—an unexpected lawsuit or disaster can put years of hard work at risk. Insurance acts as a financial safety net, stepping in when things go wrong. By working with The DeLuca Agency, you’ll have confidence knowing your coverage is structured to reduce surprises and keep your business stable.

What Makes The DeLuca Agency A Trusted Choice For Salon And Barber Insurance?

Insurance can feel complicated, especially with so many policy options. That’s why The DeLuca Agency approaches every client with a personal touch. We take the time to explain your choices, break down confusing terms, and recommend solutions based on your actual needs—not just generic packages.

Our agency has built strong relationships with top carriers, which allows us to compare multiple options and find competitive rates. More importantly, we understand the culture of Colorado’s small businesses: independent, hardworking, and community-focused. Whether you’re a single-chair stylist or the owner of a growing barbershop, we’ll be your partner in navigating risks and protecting what matters most.

How Do I Know Which Salon And Barber Insurance Plan Fits My Business?

Choosing the right coverage depends on several factors:

- Do you rent or own your salon space?

- Do you have employees or independent contractors?

- Do you sell retail products?

- How much specialized equipment do you rely on daily?

By answering these questions, The DeLuca Agency can match your situation with a coverage plan that feels both practical and affordable. We believe in flexibility—your plan should grow and adjust as your business evolves. Whether you’re just starting out or adding locations, our team will be there to reassess your needs and ensure you’re never underprotected.

Can Colorado Salon And Barber Professionals Save Money On Coverage?

Absolutely. Insurance doesn’t have to be an overwhelming expense. Many Colorado stylists and shop owners are surprised to learn how affordable a tailored policy can be. Factors like combining coverages into a business owner’s policy (BOP), maintaining strong safety practices, or choosing higher deductibles can help reduce costs.

The DeLuca Agency is committed to finding ways to balance quality coverage with smart budgeting. We’ll shop policies on your behalf, highlight discounts you may qualify for, and guide you toward options that make sense for your bottom line without sacrificing protection.

How Can I Get Started With Salon And Barber Insurance Through The DeLuca Agency?

Securing protection for your salon or barbershop is easier than most owners realize. All it takes is a conversation. When you reach out to The DeLuca Agency, we’ll start by learning about your services, your business setup, and your concerns. From there, we’ll recommend options, explain costs clearly, and answer every question along the way.

Your clients count on you to make them look and feel their best. Let The DeLuca Agency do the same for your business with comprehensive salon and barber insurance. From everyday liability concerns to unexpected disasters, we’re here to help Colorado professionals secure the protection they deserve.

Don’t wait until a claim catches you off guard. Reach out to The DeLuca Agency today and discover how easy and affordable it can be to safeguard your livelihood.

Get in touch with our team!

For questions or concerns, please contact our independent insurance agents.

CO Office

6021 S Syracuse Way Ste 207 Greenwood Village, CO 80111

Phone: 720.484.3732

MD Office

500 Redland CT Ste 106 Owings Mills, MD 21117

Phone: 410.521.6500

UT Office

2745 W 600 N Suite 500 Lindon UT 84042

Phone: 810.639.0078

Email: service@delucaagency.com